Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

August 7, 2024

Nippon Telegraph and Telephone Corporation

NOTICE REGARDING CONTINUATION OF PERFORMANCE-LINKED STOCK COMPENSATION SYSTEM FOR MEMBERS OF THE BOARD AND OFFICERS OF NTT AND ITS SUBSIDIARIES AND ADDITIONAL CONTRIBUTIONS THERETO

Nippon Telegraph and Telephone Corporation (the "company" or "NTT") hereby announces that, at a meeting of its Board of Directors held today, NTT has decided to continue its performance-linked stock compensation system (the "Compensation System") with respect to its Members of the Board and Executive Officers (excluding outside Members of the Board and those who are non-residents of Japan, collectively, the "Members of the Board or Officers"), which the company introduced beginning in the fiscal year ended March 31, 2022, and to make additional contributions of funds to the Compensation System, as further described below.

In addition, in order to continue to include Members of the Board and Executive Officers (excluding outside Members of the Board and members of Audit and Supervisory Committees, and those who are non-residents of Japan, the "Eligible Members of the Board or Officers") of certain of NTT's major subsidiaries as determined by NTT (the "Target Subsidiaries" and, together with NTT, collectively, the "Target Companies") in the scope of the Compensation System, each Target Subsidiary will continue the Compensation System in the same manner as NTT.

Furthermore, in connection with the continuation of the Compensation System, the applicable performance indicator will be EBITDA, which is the key indicator set forth in NTT's medium-term management strategy announced in May 2023.

1. Continuation of the Compensation System

- Based on the fundamental principle of "Innovating a Sustainable Future for People and Planet," NTT Group's aim is to be a company that supports global sustainability by providing its customers with new value, and shifting its business towards achieving a sustainable society, by steadily carrying out the three pillars of its "New Value Creation & Sustainability 2027 powered by IOWN" medium-term management strategy announced in May 2023: NTT as a creator of new value and accelerator of a global sustainable society; upgrading the customer experience (CX); and improving the employee experience (EX). In this instance, the Compensation System is being continued for the purpose of creating a clear correlation between the compensation of the Eligible Members of the Board or Officers and the corporate value of the company, providing increased incentive to achieve the financial targets set forth in the medium-term management strategy, and further promoting profit-sharing with shareholders by advancing the ownership by Eligible Members of the Board or Officers of the stock of their company, in order to work towards the achievement of the medium-term management strategy.

- In continuing the Compensation System, the applicable performance indicator will be EBITDA, which is the key indicator set forth in the medium-term management strategy, and the target period will consist of the remaining period under the current medium-term management strategy, which is the four-fiscal year period from the fiscal year ending March 31, 2025 to the fiscal year ending March 31, 2028.

- In connection with the continuation of the Compensation System, NTT will make additional monetary contributions to its previously-established trust (referred to herein as the "trust"), and the trust will acquire company shares as necessary from the stock market.

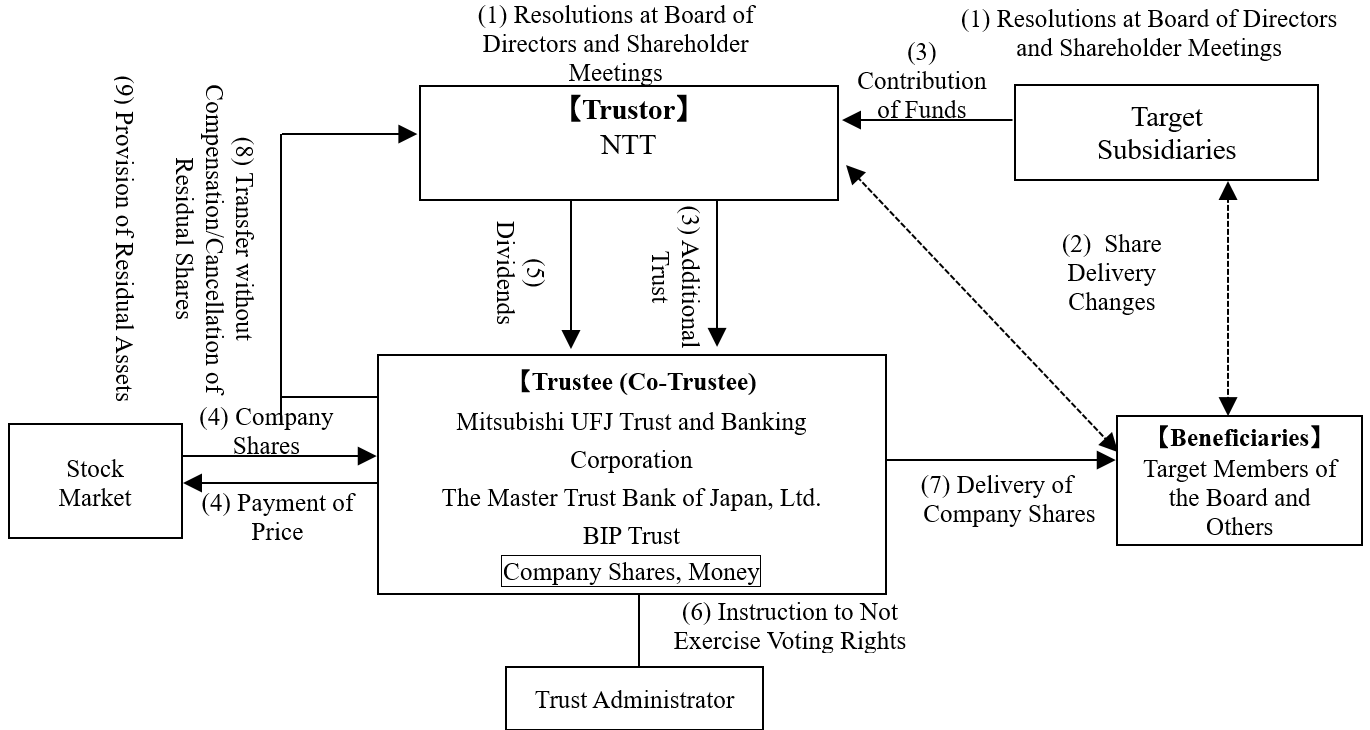

2. Overview of the Trust

- NTT and each Target Subsidiary will obtain approval for the continuation of the Compensation System with respect to each Target Company at their respective Boards of Directors.

- The respective Boards of Directors of NTT and each Target Subsidiary will revise the share delivery rules of the Compensation System.

- NTT will contribute funds that constitute the source of the funds for the compensation of the Eligible Members of the Board or Officers, and will extend the trust period for the trust, whose beneficiaries will be the Eligible Members of the Board or Officers who satisfy the beneficiary requirements.

- Pursuant to instructions from the trust administrator, the trust will acquire the company shares from the stock market with the funds contributed in (3) above and funds remaining in the previously-established trust. The number of shares to be acquired by the trust for delivery to the Members of the Board of each Target Company, or the amount of funds equivalent to the conversion price of such shares (each, a "delivery"), will not exceed the scope approved at the shareholder meetings of each company.

- Dividends on company shares held by the trust will be paid in the same manner as dividends on other company shares.

- Voting rights for the company shares held by the trust will not be exercised throughout the trust period.

- During the delivery period, Eligible Members of the Board or Officers under the trust will receive certain points pursuant to the stock delivery rules of each company and, if they satisfy the beneficiary requirements, will receive company shares equivalent to a certain ratio of points (with shares less than one unit to be rounded down) from the trust. Company shares equivalent to any residual points will be converted into cash within the trust pursuant to the trust agreement, and Eligible Members of the Board or Officers will receive money equivalent to the converted value of the company shares.

- With respect to any residual shares at the expiration of the trust period due to non-achievement of the company's results targets or other reasons, in the event that the trust continues to be used under the Compensation System or an equivalent stock compensation system, such shares will be eligible for delivery to the Eligible Members of the Board or Officers. In the event that the trust is terminated upon expiration of the trust period, as a means of shareholder returns, the trust will transfer such shares to NTT without compensation, and it is expected that NTT would cancel such shares pursuant a resolution of the Board of Directors.

- Any residual dividends on company shares held by the trust at the expiration of the trust period will be used as funds to acquire shares if the trust continues to be utilized. In the event that the trust is terminated upon the expiration of the trust period, the amount will be returned to the company within the limits of the trust expense reserve after deducting from the trust money the funds for share acquisition, and the portion exceeding the reserve for trust expenses will be donated to organizations that have no interests with NTT or the Eligible Members of the Board or Officers.

*During the trust period, if the number of shares held by the trust is likely to be insufficient for the number of Company Shares equivalent to the number of points to grant shares to the Eligible Members of the Board or Officers, or if the funds consisting of trust assets is likely to be insufficient for the payment of the trust fees and expenses, additional funds may be contributed to the trust by NTT, and additional Company Shares may be acquired by the trust.

(1) Overview of the Compensation System

The Compensation System will cover the fiscal years that are subject to the medium-term management strategy set forth by NTT (the "Target Period," with the Target Period consisting of the remaining period under the current medium-term management strategy, which is the four-fiscal year period from the fiscal year ending on March 31, 2025 to the fiscal year ending on March 31, 2028), and is a system for delivery of Company Shares as executive compensation depending on the position of the Eligible Members of the Board or Officers and the degree to which financial targets under the medium-term management strategy have been achieved, among other factors. Furthermore, in the event of the continuation of the trust thereafter (in each case such continuation is referred to herein, as set forth in Section 4(b) below), the fiscal years that correspond to subsequent medium-term management strategies will be set as the target periods.

(2) Resolutions of Boards of Directors with Respect to the Continuation of the Compensation System

In connection with the continuation of the Compensation System, with respect to the executive compensation of the Members of the Board of each Target Company who are eligible under the Compensation System, the trust agreement will be amended at the end of the trust period and additional contributions will be made to the trust pursuant to board resolutions, within the scope approved at the shareholder meetings for the adoption of the Compensation System. Furthermore, necessary matters regarding the executive compensation of Executive Officers of each Target Company who are eligible under the Compensation System will also be resolved pursuant to board resolutions.

(3) Persons Eligible for the Compensation System (Beneficiary Requirements)

The Eligible Members of the Board or Officers, subject to meeting the beneficiary requirements described below and upon completing the required beneficiary verification procedures, will be able to have Company Shares delivered from the trust in an amount corresponding to the number of stock delivery points.

The beneficiary requirements are as follows:

- The person is an Eligible Member of the Board or Officer from and after the date the system begins (including persons who newly become Eligible Members of the Board or Officers after the date the system begins)

- The person has retired from the position of an Eligible Member of the Board or Officer* or those who are non-residents of Japan

- The person has not retired due to personal reasons (excluding resignations due to injury, illness or other unavoidable circumstances approved by NTT) or dismissal, and has not engaged in any illegal or inappropriate activities during his or her tenure

- Other requirements that are determined to be necessary to accomplish the purpose of a performance-linked stock compensation system

*However, in the event that the trust period is extended pursuant to Section 4(c) below and such Eligible Member of the Board or Officer is still in office as a person eligible for the system following the expiration of the extended trust period, the trust will be terminated at such time, and delivery of the Company Shares for such eligible person will be conducted while such person remains in office.

(4) Trust Period

a. Extended Trust Period

The four-year period from 2024 to 2028

b. Continuation of the Trust

Upon the expiration of the trust period, the trust may be continued by means of amendment of the trust agreement or creation of an additional trust. In such an event, the number of fiscal years that corresponds to the medium-term management strategy established by NTT at such time will be set as the new target period, the trust period will be extended to correspond to such new target period, and distributions of points to Eligible Members of the Board or Officers will continue to be made during the duration of the extended trust period. For any additional contributions made to the trust during the new target period, executive compensation for Members of the Board of each Target Company will be made within the scope of the maximum amounts of funds to be contributed to the trust that have been approved at the applicable shareholder meetings for the adoption of the Compensation System. In the event that such additional contributions are made, however, if there are any Company Shares (excluding Company Shares corresponding to points granted to Eligible Members of the Board or Officers for which Delivery has not been completed) or funds that remain in the trust's property on the last day of the trust period prior to the extension (collectively, "Residual Shares"), the total amount of Residual Shares corresponding to the executive compensation for Members of the Board of each Target Company, plus additional contributions of funds to the trust, will be within the scope of the maximum amounts approved at the applicable shareholder meetings for the adoption of the Compensation System. Extensions of the trust period will not be limited to one extension; the trust period may also be re-extended thereafter in the same manner.

c. Expiration of the Trust (Extension of Trust Period without Additional Contributions)

Even in the event that the trust expires, if there are Eligible Members of the Board or Officers who may meet the beneficiary requirements at the time of the expiration of the trust period (or, in the event of a continuation of the trust as described in (b) above, the as-extended trust period), the trust will not be terminated immediately, but rather, the trust period will be extended for a specified limited period of time. In such an event, however, new distributions of points to Eligible Members of the Board or Officers will not be made.

(5) Calculation Method for the Number of Company Shares to be Provided for the Delivery to Eligible Members of the Board or Officers

At a specified time each year during the trust period, points calculated in accordance with the following formula ("Reference Points") will be granted on the basis of the position of each Eligible Member of the Board or Officer. At a specified time following the last day of the final fiscal year of the target period, the number of Company Shares to be delivered will be determined based on the number of Reference Points accumulated during the trust period ("Accumulated Points") multiplied by the performance-linked co-efficient.

The performance-linked co-efficient will be assessed based on financial targets and other metrics set forth in NTT's medium-term management strategy. For the target period, the performance-linked co-efficient will be determined within a range of 0-150% at the end of the final fiscal year of the target period (the fiscal year ending March 31, 2028) based on the degree to which the EBITDA financial target has been achieved.

(Reference Point Formula)

Reference stock compensation amount based on position ÷ average closing share price of the company's shares on the Tokyo Stock Exchange in the month prior to the start of the target period (rounded down to the nearest whole number)

The number of Company Shares that will be subject to delivery to the Eligible Members of the Board or Officers through the trust will be one Company Share per one point, with any fraction less than one point rounded down. If, however, a stock split or reverse stock split occurs with respect to company shares during the trust period, the number of company shares per point will be adjusted in accordance with the stock split ratio or reverse stock split ratio, as applicable.

In addition, in the event that an Eligible Member of the Board or Officer retires or passes away or becomes a non-resident of Japan during the trust period, the number of shares to be delivered will be determined using the number of Accumulated Points as of such time as the number of points for share delivery.

(6) Method of Delivery of the Company Shares to the Eligible Members of the Board or Officers, and Period of Delivery

In the event that an Eligible Member of the Board or Officer who meets the beneficiary requirements retires (excluding instances in which such person passes away), such Eligible Member of the Board or Officer will, upon completing certain specified beneficiary verification procedures, receive company shares from the trust in a number corresponding to a specified percentage of the points for share delivery (rounded down), and with respect to the number of company shares corresponding to the remaining points for share delivery, funds corresponding to the exchange payment will be delivered after such shares are redeemed within the trust. If an Eligible Member of the Board or Officer who meets the beneficiary requirements passes away during the trust period, company shares corresponding to the number of points for share delivery calculated at such time will be redeemed within the trust, and the heirs of such Eligible Member of the Board or Officer will receive a distribution from the trust. If an Eligible Member of the Board or Officer who meets the beneficiary requirements becomes a non-resident of Japan during the trust period, company shares corresponding to the number of points for share delivery calculated at such time will be redeemed within the trust, and the Eligible Member of the Board or Officer will receive a distribution from the trust.

(7) Maximum Total Amount of Funds to be Contributed to the Trust for NTT's Members of the Board or Officers and Maximum Total Amount of Points to be Granted

The maximum total amount of funds to be contributed to the trust for purposes of the acquisition of company shares for delivery to NTT's Members of the Board or Officers, and the maximum total amount of points to be granted to NTT's Members of the Board or Officers, are as described below.

- Maximum Amount of Funds to be Contributed to the Trust(1)

¥0.1 billion for Members of the Board, with the maximum aggregate amount of funds to be contributed to the trust during the target period (four fiscal years) to be ¥0.4 billion. In the event that there is a continuation of the trust as described in Section 4(b) above, the maximum aggregate amount of funds to be contributed to the trust will be an amount equivalent to the maximum amount of trust funds for one fiscal year (¥0.1 billion) multiplied by the number of years in the new target period. - Maximum Total Amount of Points to be Granted to Eligible Members of the Board or Officers(2)

1.175 million points per each fiscal year (equivalent to 1.175 million shares). Therefore, the maximum aggregate number of company shares to be acquired by the trust will be 4.7 million shares, which is the product of the amount per fiscal year multiplied by four (the number of years in the four-fiscal year target period). In the event that there is a continuation of the trust as described in Section 4(b) above, the maximum aggregate number of the company shares to be acquired by the trust will be an amount equivalent to the maximum amount of points for one fiscal year (1.175 million points) multiplied by the number of years in the new target period.

- Represents the aggregate amount of funds for stock acquisitions by the trust and for trust fees and expenses for the duration of the trust period.

- The maximum total amount of points to be granted to NTT's Members of the Board or Officers is determined based on the maximum amount of trust funds listed above and by reference to the stock price at the time the Compensation System was adopted and other factors.

Reference:

The major subsidiaries designated by NTT for continuation of the Compensation System are as follows:

- NTT DOCOMO, Inc.

- Nippon Telegraph and Telephone East Corporation

- Nippon Telegraph and Telephone West Corporation

- NTT Communications Corporation

- NTT Urban Solutions, Inc.

(8) Method of Acquisition of Company Shares by the Trust

Company shares acquired by the trust are anticipated to be acquired from the stock market.

Acquisitions of company shares with respect to NTT's Eligible Members of the Board or Officers will be conducted in an amount of shares within the scope that corresponds to the maximum total amount of acquisition funds and maximum total amount of points granted to the Members of the Board or Officers described in (7) above.

(9) Clawback System

A system has been established such that, in the event that an Eligible Member of the Board or Officer engages in significant illegal or inappropriate activity, or takes employment at another company in the same industry without the permission of the company, the system will enable the revocation of rights to receive Company Shares under the Compensation System with respect to such person (malus clause) and the request for the return of funds corresponding to previously delivered Company Shares (clawback).

(10) Exercise of Voting Rights of Company Shares within the Trust

In order to maintain the neutrality of management, voting rights with respect to company shares held within the trust (i.e., company shares held before delivery to the Target Members of the Board and Officers as described in (6) above) will not be exercised during the trust period.

(11) Dividends on Company Shares within the Trust

Dividends on company shares held within the trust will be received by the trust and applied to the trust's fees and expenses.

(12) Expiration of the Trust Period

With respect to any residual shares at the expiration of the trust period due to non-achievement of the company's financial targets or other reasons, in the event that the trust continues to be used under the Compensation System or an equivalent stock compensation system, such shares will be eligible for delivery to the Eligible Members of the Board or Officers. In the event that the trust is terminated upon expiration of the trust period, as a means of shareholder returns, the trust will transfer such shares to NTT without compensation, and it is expected that NTT would cancel such shares pursuant a resolution of the Board of Directors.

In addition, any residual dividends on the company shares held by the trust that exist at the expiration of the trust period will be used as funds to acquire shares if the trust will continue to be used. If, however, the trust is terminated due to the expiration of the trust period, the residual dividends will vest in NTT within the extent of reserves for trust expenses, which are calculated by deducting funds for acquiring shares from the trust money, and the portion exceeding the reserves for trust expenses will be donated to organizations that have no interests with NTT or the Eligible Members of the Board or Officers.

(13) Other

Please see NTT's Annual Securities Report for additional information regarding NTT's compensation policies and processes.

https://group.ntt/en/ir/library/yuho/2023/pdf/39yuho.pdf

Reference:

Details of the Trust Agreement

| (1) Type of Trust: | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) |

| (2) Purpose of Trust: | Providing incentives to the Eligible Members of the Board or Officers |

| (3) Trustor: | NTT |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Co-Trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Retired Eligible Members of the Board or Officers who satisfy the beneficiary requirements |

| (6) Trust Administrator: | Third party with no interests with NTT (certified public accountant) |

| (7) Exercise of Voting Rights: | No voting rights will be exercised. |

| (8) Trust Agreement Date: | August 12, 2021 (amendment planned for August 13, 2024) |

| (9) Trust Agreement Term: | From August 12, 2021 to August 31, 2024 (subject to a planned extension to August 31, 2028 through an amendment of the Trust Agreement) |

| (10) Compensation System Start Date: | August 12, 2021 |

| (11) Type of Shares to be Acquired: | Shares of NTT's common stock |

| (12) Amount of Shares to be Acquired: | 2.44 billion yen (planned) (total amount of additional shares to be acquired for Eligible Members of the Board or Officers) * Includes amounts remaining in the existing trust. |

| (13) Share Acquisition Period: | From August 16, 2024 to August 23, 2024 (planned) (excluding the period from the fifth business day prior to the last day of the accounting period (including semiannual and quarterly accounting periods) to the last day of the accounting period). |

| (14) Method of Share Acquisitions: | Acquisitions from the stock market |

| (15) Rights Holder: | NTT |

| (16) Residual Assets: | The residual assets that NTT, as the rights holder, may receive will be within the extent of reserves for trust expenses, which are calculated by deducting funds to acquire shares from the trust funds. |

Note:The timing scheduled above may be changed to appropriate times in light of applicable laws and regulations.

For further inquiries, please contact

Ooshima, Urakawa

Investor Relations Office, Finance and Accounting Department

Nippon Telegraph and Telephone Corporation

Phone: +81-3-6838-5481

Information is current as of the date of issue of the individual press release.

Please be advised that information may be outdated after that point.

NTT STORY

WEB media that thinks about the future with NTT