Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

When you select a year, you can see the list of articles for the selected year.

May 12, 2022

CEO Press Conference

Financial Results for the 2021 Fiscal Year and Financial Forecasts for the 2022 Fiscal Year

Jun Sawada, President and Chief Executive Officer, Representative Member of the Board

Also in attendance were:

Kazuhiko Nakayama, Senior Vice President, Head of Finance and Accounting Dept.

Takashi Taniyama, Senior Vice President, Head of Corporate Strategy Planning Dept.

(Jun Sawada)

I'll now share our Financial Results for the 2021 fiscal year and our Financial Forecasts for the 2022 fiscal year.

Our operating revenue and operating income for the 2021 fiscal year both increased year-on-year and our operating revenue, operating income and profit for the period were all record highs. Our profit for the period exceeded 1 trillion yen for the first time. Our operating revenue increased by 212.5 billion yen year-on-year to 12.1564 trillion yen due to factors such as an increase in revenue for NTT DATA. Around 127 billion yen of that 212.5 billion yen was the result of a favorable exchange rate. Operating income increased by 97.2 billion yen year-on-year to 1.7686 trillion yen due to revenue increases in companies such as NTT DATA and cost reductions. Profit for the period increased by 264.9 billion yen year-on-year to 1.1811 trillion yen due to factors such as the increase in operating income, acquisition of minority stockholders' shares in NTT DOCOMO in order to make it a wholly owned subsidiary, and temporary profit-increasing factors such as corporate tax matters. The overseas operating income ratio increased by 3.3 points to 6.3% due to factors such as NTT DATA's revenue increase and the effects of our structural reform, and we are on track to meet our target of 7% overseas operating income ratio by our 2023 fiscal year.

In January 2022, NTT Communications and NTT COMWARE were transferred to the NTT DOCOMO Group. Accordingly, our segments are being revised, starting with the financial results for the end of the 2021 fiscal year. First, since NTT Communications and NTT COMWARE have been transferred to our mobile communications business, this has now been renamed as our Integrated ICT Business Segment. NTT Ltd., which was part of our long distance international communication business segment, will be combined with our data communications business to form our Global Solutions Business Segment. Business results dating back to the 2020 fiscal year are calculated according to each constituent division's results for that period in order to make year-on-year comparisons. Our new segments are integrated ICT, Regional Communications, Global Solutions and Other, the latter of which encompasses our real estate and energy businesses.

I'll now announce the revenue and operating income for each segment.

In our integrated ICT Business Segment, mobile communications revenue decreased. Factors such as price decreases led to a decrease in revenue for NTT DOCOMO and voice revenues also decreased for NTT Communications, leading to an overall decrease in revenue year-on-year. Operating income for this segment increased due to an increase in operating income in NTT DOCOMO's smart lifestyle business, along with cost reductions.

NTT DOCOMO itself ended the 2021 fiscal year with a 11.4 billion yen decrease in non-consolidated operating revenue and a 14.7 billion yen increase in non-consolidated operating income year-on-year.

In our Regional Communications Business Segment, both operating revenue and operating income increased year-on-year due to an increase in IP and packet communications revenue, particularly in optical services at both NTT East and NTT West, along with the change in the accounting system and cost reduction measures.

In our Global Solutions Business Segment, a drop in operating income occurred due to the higher costs incurred by the structural reform of NTT Ltd., but a considerable growth in demand for digital technology from NTT Data contributed to an increase in operating income. Overall, both operating revenue and operating income increased year-on-year.

In the segment encompassing other businesses, results for the 2020 fiscal year were impacted by soaring electric power procurement costs, but these businesses rebounded during the 2021 fiscal year, with both operating revenue and operating income increasing year-on-year.

Next, I'll announce our Financial Forecasts for the 2022 fiscal year. This year is critical for implementing the measures that are needed in order to accomplish our medium-term financial targets for the 2023 fiscal year.

Specifically, as we face a wide range of risks including intensifying global issues, the ongoing COVID-19 pandemic and an increase in natural disasters, we will take measures in areas such as creating synergies in the NTT DOCOMO Group, growing our overseas operations and further promoting digital transformation (DX), with the aim of achieving our Financial Forecasts and working toward a further increase in operating income in the 2023 fiscal year.

EPS was 329 yen in the 2021 fiscal year, and we aim to increase this to 340 yen in the 2022 fiscal year.

I'll now provide an overview of our Financial Forecasts for each segment in the 2022 fiscal year. We expect to see an increase in both operating revenue and operating income.

In the Integrated ICT Business Segment, price decreases will continue to affect operations, but we will work to cancel out the decrease in operating income in our consumer communications business by growing businesses such as our corporate business and smart lifestyle business so that we can achieve an increase in both operating revenue and operating income. We expect non-consolidated operating revenue and operating income for NTT DOCOMO to increase year-on-year too.

In our Regional Communications Business Segment, we aim to achieve a year-on-year increase in both operating revenue and operating income through an increase in IP and packet communications revenue, particularly in optical services at both NTT East and NTT West, along with cost reduction measures.

In our Global Solutions Business Segment, we expect to see more of the robust demand for digital technology solutions from NTT DATA that we saw in the 2021 fiscal year. We also expect to see an increase in revenue of high value added services from NTT Ltd., along with a reduction of costs as a result of our structural reform, and therefore we expect both Operating Revenue and Operating Income to increase year-on-year.

I'll now give a breakdown by company. We announced the realignment between NTT DATA and our global business on May 9.

NTT Ltd. will be transferred to the NTT DATA Group from the second half of this fiscal year. Our revenue projection for NTT Ltd. for the first half of the year is 600 billion yen. As a reference, if we were not planning on realigning the companies, we might expect to see NTT DATA's operating Revenue for the full year increase by 108.1 billion yen and NTT Ltd.'s operating revenue increase by 165.3 billion yen. The revenue increases at NTT DATA and NTT Ltd. are due to an increased backlog of projects that will be carried out in the 2022 fiscal year, including those that were put on hold due to the semiconductor shortage.

In terms of profit for the period, we are increasing the ratio of NTT DATA's overseas operations through the realignment and making additional investments in NTT DATA. We do not expect the NTT Group's overall profit for the period to be impacted.

I'll now talk about trends in operating revenue and income over the past few years.

When I reported on our results for the first quarter of the 2021 fiscal year, our operating revenue had increased but our operating income had decreased, and we were unsure of whether we were back on track, so for this analysis, I have broken down our financial results by quarter. In the 2018 fiscal year, both our operating revenue and our operating income increased. In the 2019 fiscal year, our operating revenue increased but our operating income decreased due to price decreases for NTT DOCOMO. The 2020 fiscal year began with a decrease in both operating revenue and operating income due to COVID-19, although we managed to regain a lot of ground. In the 2021 fiscal year, we got back on track as predicted and ended up exceeding our Financial Forecasts. We expect that both operating revenue and operating income will continue to increase in the 2022 fiscal year.

I'll now provide an update on our progress toward our medium-term financial targets.

As I mentioned before, EPS for the 2021 fiscal year was 329 yen. Our initial target for the 2023 fiscal year, which we set in the 2018 fiscal year, was 320 yen, so we have achieved that goal two years early. This target was increased to 370 yen last fall, so we will continue working toward the new target by improving the synergy in the new NTT DOCOMO Group, growing our overseas operations and promoting DX. We expect EPS to increase to 340 yen in the 2022 fiscal year, and we aim to continue to grow it further in the following fiscal year.

We expect to meet our overseas operating income ratio target one year early in the 2022 fiscal year.

Our initial cumulative cost reduction target of 800 billion yen was met in the 2021 fiscal year, two years early. We aim to keep reducing costs at a similar pace from the 2022 fiscal year onward, and are on track to meet our new targets of 930 billion yen for the 2022 fiscal year and at least 1 trillion yen for the 2023 fiscal year.

For ROIC, we are making good progress toward our 2023 fiscal year target of 8%.

Lastly, our initial capex to sales target of 13.5% or lower was met in the 2021 fiscal year, with a figure of 13.1%.

We are not setting an overseas sales target at present, as we revised our medium-term financial targets last October.

Regarding shareholder returns, our Board of Directors resolved today that our projected dividends for the 2022 fiscal year will be 120 yen per share, a 5-yen increase year-on-year. This will be the 12th consecutive increase, with increases every year since the 2011 fiscal year.

Accordingly, it was also resolved that share buybacks of a maximum of 400 billion yen in total will be conducted.

I have four news items to share. The first is our reorganization. In June 2022, we will place our Internal Auditing Department under the direct report of our President. With global risks causing dramatic changes in our business environment, we needed to make our internal audits more independent. We have also strengthened our global corporate marketing and communications and established a new IOWN Product Design Center.

The second news item is our Space Business, which we announced a while ago. In July, we will establish Space Compass, jointly with Sky Perfect JSAT.

The third news item is our sustainability initiatives. We are making strong progress toward our goal to reduce greenhouse gas emissions by 34%, or 3.075 million tons, compared to our emissions in the 2013 fiscal year. In our B2B2X initiatives, we are aiming to meet our revenue target of 600 billion yen a year early. In addition, our companies collectively have almost met our target of a 30% rate of new female manager appointments this February, and we will continue working on this initiative. We are also considering reflecting these three points in executives' compensation.

As for our progress on our medium-term business management strategies, the presentation materials contain information on the progress of our initiatives since February 2022.

This concludes my presentation.

Q&A

-

I get the impression that another reason why you changed your management lineup at this time is because after the incident where executives dined with a member of the Ministry of Internal Affairs and Communications, the public servant lost his job but you remained in your role as President. Some of your executives did step down; was it because of that incident? I'd like to know more about what happened there.

As you mentioned, we have reorganized our management structure. We also decided that at least 30% of our directors, 30% of our executive officers and 30% of our auditors must be women. In terms of the reason why we made these changes at this time, firstly, the last four years have been an extremely difficult time for us, particularly the last two years, during which we have dealt with COVID-19 and then the war that began this year, along with industry issues such as the need to reduce prices, the extreme changes in our business environment, and in our case there was the matter of the dinners with officials too. With all of that going on, it was pretty much clear to us that we needed to make fundamental structural changes, like making remote work a standard practice or changing our management style. And the reorganization of our management structure was a core element of that. My choice to step down as President and CEO and become the Chairman instead is the result of us deciding to take this direction.

-

What are your thoughts about your remaining as representative director for now?

As representative director, I still have the same responsibilities in my mind, and you may remember that the global realignment of NTT DATA and NTT Ltd. is in October. The restructuring of NTT DOCOMO, NTT Communications and NTT COMWARE is coming up before that, in July, and there are still areas that we need to work on with that, so with that in mind, the idea is for me to share my responsibilities for the time being, which includes remaining as the company's representative. With that said, as I will remain the Chairman of the Board of Directors, I will basically be in charge of the governance side, and will play a supporting role in work such as the realignment of NTT DATA and our IOWN initiatives in my capacity as representative director.

-

Regarding the reduction of mobile phone service prices, I'd like to know how much mobile phone communication revenue has fallen as a result of this, and what you expect to happen to your revenue in this area from the 2022 fiscal year onward.

The decrease due to the price reduction was 270 billion yen in the 2021 fiscal year. Obviously that 270 billion yen does not directly impact our income as we also no longer have to pay the costs for Monthly Support, but basically revenue fell by 270 billion yen.

In terms of the future, we have released ahamo, which makes it easy for users to choose the service they want. It will depend on what our existing customers do and how our competition with other companies plays out, but we can say for sure that there will be more cheap plans, so we'll see a bigger impact.

With that said, the starting point was two years ago--we're not going to lose 270 billion yen every year. But expect an extension of what we're seeing now. -

What are your thoughts on the impact of the semiconductor shortage?

As far as we can see, we will continue to be impacted by the semiconductor shortage for almost another year. NTT Ltd. has been impacted the most severely. For example, their business that sells and maintains equipment such as routers and servers has been receiving orders but has not been able to obtain the necessary items, so some things have remained up in the air, which significantly affected their business plan in the previous fiscal year. We're assuming that this will continue during this fiscal year, but with some alleviation of impact, they will finally be able to get revenue for items that were ordered before, so the greatest elements of that impact will decrease.

With that said, NTT DOCOMO is likely to continue seeing impacts, such as not receiving iPad shipments or, in the case of some products, needing to use different products or devices due to the semiconductor shortage. We expect operations to continue as they are at present. -

Regarding your overseas operating income ratio, you mentioned that you will meet your target a year early. What was the background behind that?

Also, at the announcement of the realignment between NTT DATA's overseas operations and NTT Ltd. the other day, it was mentioned that a new joint company would be established. Did you have the synergy from that merger in mind when you worked to meet that target early?First, we are not expecting to see any immediate synergy as a result of this realignment. Any positives of this realignment will be ad hoc in the short term. There are two reasons why we have reached 6.3% of overseas operating income margin at this point. The first is that NTT DATA has had incredible increases in revenue, profit and orders. Those positives have to do with what we call "offense", which basically means expanding sales, and that has been a key supporting factor. The other reason is that, particularly in the case of NTT Ltd. and NTT DATA, we have made significant progress in our structural reform since the 2020 fiscal year, and are reaping the benefits now.

As a result, where our ratio of overseas operating income was around 3% in the 2020 fiscal year, it doubled to 6.3% in the 2021 fiscal year and, at present, we expect it to increase to over 7% from the 2022 fiscal year onward, so our goal for the 2023 fiscal year will be exceeded in the 2022 fiscal year without any extra synergy at all. If we did have that kind of synergy, I imagine that this figure would be even higher. -

I'd like to know the specifics of how you achieved record profits of over 1 trillion yen for the period.

Since we have over 1 trillion yen in profit for this period, obviously our profit has increased. This is due to extremely strong performance on the revenue side, particularly from NTT DATA, along with cost reductions. If we break it down by segment, NTT DATA was a major contributor to our revenue in the 2021 fiscal year, and we have also seen improvements in profit in each segment, which means costs have been reduced.

Another driving force behind these profits of over 1 trillion yen was that NTT DOCOMO became a wholly owned subsidiary and so we acquired their profits, which increased our total profits by 160 billion yen.

We also experienced temporary profit-increasing factors such as corporate tax matters, which pushed our profits above 1 trillion yen. -

I'd like to know how the situation with Russia will impact you. NTT DATA has said that it will pull out of the area; how will you account for that?

Regarding our Russian businesses, NTT DATA's business is already in the process of selling. (Note: The sale process was completed on May 13, 2022, which means that NTT DATA exited Russia after this press conference.)

NTT Ltd. has stopped taking any new orders for its cloud and network services. We have taken this action because we need to work together with our existing customers, and these are not only Japanese multinational corporations, to figure out how to leave the area or stop serving there. The scale of the business is not particularly large; we had around 190 employees in Russia and around 30 in Ukraine*.*This answer has been partially amended.

-

Do your financial projections for this period take into account the synergy created by your global realignment?

Our financial forecasts for this period do not take this into account. The synergy will come a little later--the realignment will be finalized in October 2022, so in a way that is the beginning, so it's difficult to incorporate that in the 2022 fiscal year.

-

How much is the synergy of the new NTT DOCOMO Group being taken into account in this period?

We have already begun merging some of our businesses, like our video business. The main components of the merger, such as the merging of our networks, actual sales activities and the merging of our processes, will take place from July onward, but we are expecting an increase of around 30 billion yen in smart lifestyle areas such as video, along with corporate services, due to that synergy.

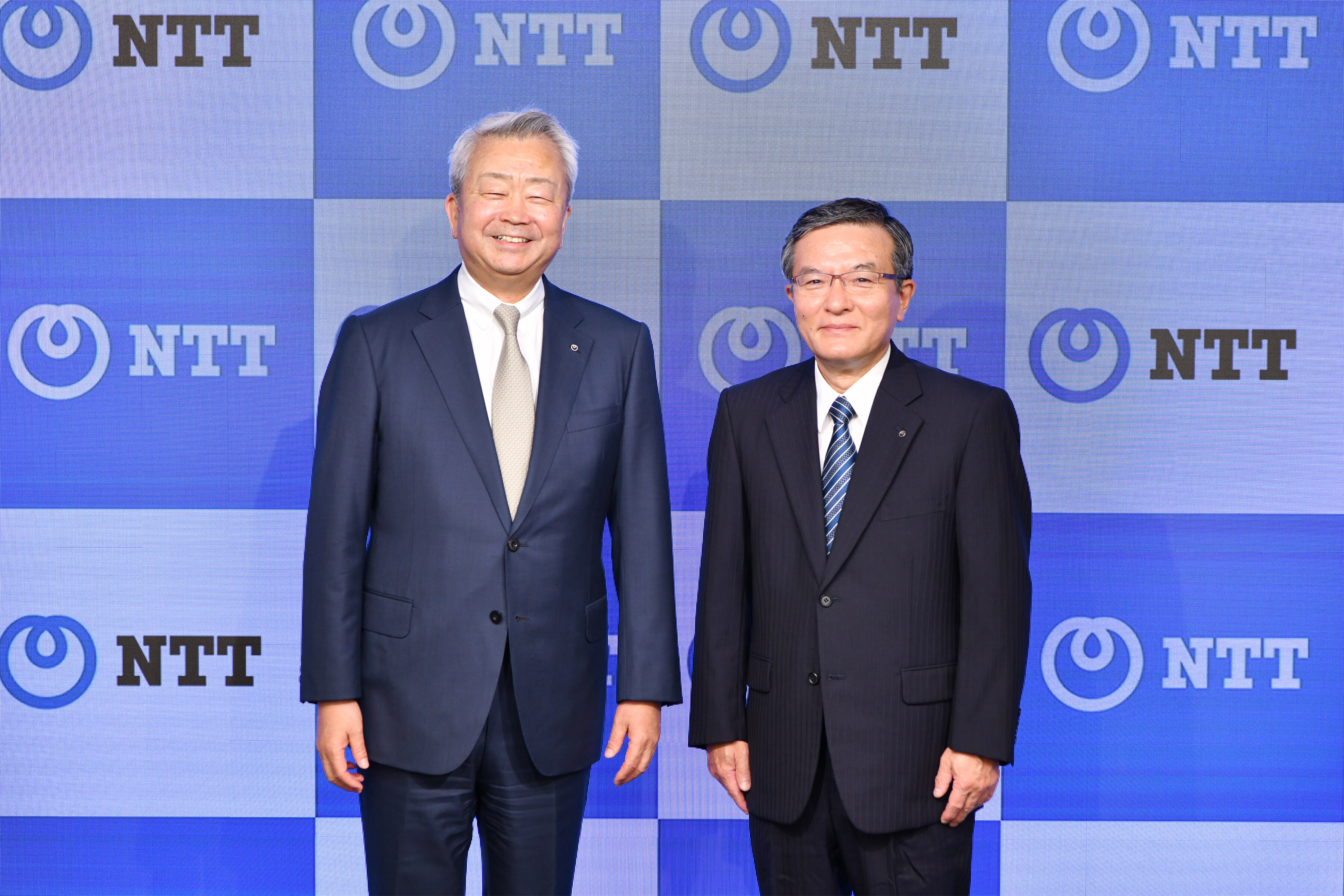

Reorganization of management structure

Jun Sawada, President and Chief Executive Officer, Representative Member of the Board

Also in attendance:

Akira Shimada, Senior Executive Vice President and Representative Member of the Board

(Jun Sawada)

I'll now explain the reorganization of our management structure. The rationale behind this was to establish a new management style and strengthen our governance. There was also the matter of the dinners with officials, which prompted us to review what has been going on, including potential conduct issues that are considered acceptable because "that's what we've always done", and take measures to strengthen our governance.

We have increased the number of directors from eight to ten. Five of them--50%--are outside members of the board. Since I am the Chairman, this means that six directors are on the governance side.

To strengthen our auditing framework, we have added an outside corporate auditor as a standing auditor, increasing our Audit & Supervisory Board from five members to six. In our new lineup, over 30% of our directors, auditors and executive officers are female.

I explained about our internal auditing department earlier. We have also appointed a person in charge of economic security.

Since we had set a direction to take as we navigate these difficult changes in our business environment, I wanted to take the opportunity to reorganize our management structure, especially as our strong business results gave us the means to do so.

I'll now talk about why I appointed Akira Shimada. Senior Executive Vice President Shimada served as head of our General Affairs Department after I was appointed Senior Executive Vice President of this holding company eight years ago. We worked together in the four years that I spent as the CFO and CCO, and then for another four years after I became President and he was appointed as my successor in my previous positions. This means we have spent eight years reforming NTT together. He has also worked overseas twice. His experience working for various companies in the NTT Group, including NTT East and West, NTT Com and NTT DATA, along with his experience outside the group, has given him a well-balanced base to draw from, and I believe that he is the ideal leader for the strides the company will make in future.

I am sure that he will further expand the scope of the work we are doing at present, make improvements and accomplish what we are setting out to do.

(Akira Shimada)

As President Sawada mentioned, I have learned about managing the NTT Group under President Sawada over the last four years. As I lead the group in future, I aim to take the next steps in the reforms that President Sawada has worked on so far. With so many things unclear at present--the state of the economy, our business environment, the way forward--we will need to adapt to the changes we encounter, and at times anticipate future changes and pre-emptively change NTT's course, so that we have a viable path ahead of us.

I aim to make sure the NTT Group can make dynamic transformations again and again. And as we constantly evolve, I will do whatever it takes to keep providing our customers with new experiences and excitement.

I look forward to working with you all.

Q&A

-

Senior Executive Vice President Shimada, you explained that you want to make sure the NTT Group can make dynamic transformations again and again. What is your vision for NTT five or ten years from now, and how do you plan to accomplish it?

(Sawada) The NTT Group plans to have IOWN up and running by 2030. In doing so, we will facilitate advances in telecommunications that will transform society and represent a step toward a data-driven society. Our fundamental aim here is to be a partner for society, providing support on both the technical side and the services side to build a society that ensures the wellbeing of everyone in it. To do this, I want NTT to start by developing game-changing technology and then put it in place over the next five to ten years.

(Shimada) First, I want to make NTT a company that both our corporate customers and our individual customers will be glad they chose five or ten years from now. In order to do that, I aim to work together with our 330 thousand employees and partners around the world to bring our customers new experiences and excitement.

As President Sawada just said, we are likely on the verge of a data-driven world. Even in areas such as medicine, bases of real-world data are rapidly being built. Ultimately, we are likely to see personalized, precision treatments--for example, it is now possible to use genome information to determine who a medicine will work on. I want to make NTT a company that can use advances like these to create new experiences and excitement. -

I think that NTT's overseas businesses will become increasingly important for the company's growth in future. How important do you think it will be to expand your overseas operations in future? And what do you plan on doing to achieve that growth?

(Shimada) It was recently announced that NTT DATA and NTT Ltd. will work together on our global business that serves businesses. NTT DATA aims to be one of the top five companies in the world in the IT and ICT fields.

I don't think NTT DATA is there yet. So they need to think about how they'll get there. Obviously they also need to think of ways to grow organically, and I think M&A in new fields will be necessary. In the business field, I think the first step is growing the new company that is being established for their overseas operations.

And then, for example, NTT DOCOMO is preparing for a global expansion of its app and O-RAN businesses, so we will need to expand our global businesses in other fields too.

I think what we're doing right now with our corporate business is only part of what needs to be done. We also need to consider measures such as expanding our global businesses in a wider range of fields. -

When you became President four years ago, according to some reports, you created a list of 140 things that needed to be done. I'd like to hear about things you set out to do and accomplished during your four years as President, or, conversely, things you regret not doing and would like to see Mr. Shimada do in future.

(Sawada) About 20% of those things no longer apply due to changes in circumstances, but I managed to do around 80% of the other 80%.

As for the remaining things, I wouldn't say they're remaining per se. The world around us is moving so quickly. With that in mind, I want to see the NTT Group become a stronger, better company, one where everyone is proud of what they do, one that creates true value for its customers, one that works collectively to create all kinds of value. I think that's an eternal theme, but in any case, that is what I hope for.

Corporate

NTT Group Medium-Term Management Strategy

New Value Creation & Sustainability 2027 Powered by IOWN

We announced our new NTT Group medium-term management strategy which is based on the fundamental principle "Innovating a Sustainable Future for People and Planet" in May 2023

NTT STORY

WEB media that thinks about the future with NTT