Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

May 12, 2021

Company Name: Nippon Telegraph and Telephone Corporation

Representative: Jun Sawada, President and Chief Executive Officer

(Code No.: 9432, First section of Tokyo Stock Exchange)

NOTICE REGARDING ADOPTION OF PERFORMANCE-LINKED STOCK COMPENSATION SYSTEM FOR MEMBERS OF THE BOARD AND OFFICERS OF NTT AND ITS MAJOR SUBSIDIARIES

Nippon Telegraph and Telephone Corporation (the "company" or "NTT") hereby announces that, at a meeting of its Board of Directors held today, NTT resolved to adopt a performance-linked stock compensation system (the "Compensation System") with respect to its Members of the Board and Executive Officers (excluding outside Members of the Board and those who are non-residents of Japan, collectively, the "Members of the Board or Officers"), as further described below.

In addition, in order to include Members of the Board and Executive Officers (excluding outside Members of the Board and members of Audit and Supervisory Committees, and those who are non-residents of Japan, the "Eligible Members of the Board or Officers") of certain of NTT's major subsidiaries as determined by NTT (the "Target Subsidiaries" and, together with NTT, collectively, the "Target Companies") in the scope of the Compensation System, the Board of Directors of each Target Subsidiary is also expected to resolve to adopt the Compensation System in the same manner as NTT.

As a result, NTT plans to submit for approval a proposal regarding the adoption of the Compensation System at the company's 36th Ordinary General Meeting of Shareholders scheduled to be convened on June 24, 2021, and each Target Subsidiary is expected to submit a related proposal for approval at its respective meeting of shareholders to be held in the future (the respective meetings of shareholders of NTT and of each of the Target Subsidiaries, collectively, the "Shareholder Meetings").

1. Purpose of the Compensation System

- NTT Group's vision is to aim to resolve social issues, together with all of its partners, through its business activities as "Your Value Partner." NTT has been steadily carrying out the four pillars of its "Your Value Partner 2025" medium-term management strategy announced in November 2018: supporting NTT's customers' digital transformations; accelerating NTT's own digital transformation; leveraging talent, technologies and assets; and promoting ESG management and enhancing the returns of shareholders to improve corporate value. In doing so, NTT aims to contribute to the realization of a smart society: Smart World/Society 5.0. In this instance, the Compensation System is being adopted for the purpose of creating a clear correlation between the compensation of the Eligible Members of the Board or Officers and the corporate value of the company, providing increased incentive to achieve the financial targets set forth in the medium-term management strategy, and further promoting profit-sharing with shareholders by advancing the ownership by Eligible Members of the Board or Officers of the stock of the company, in order to work towards the achievement of the medium-term management strategy.

- The adoption of the Compensation System is subject to receiving approval of the proposal regarding the introduction of the Compensation System at the Shareholder Meetings.

- The Compensation System will adopt an executive compensation structure referred to as a BIP (Board Incentive Plan) trust (referred to herein as the "trust"). The trust, like performance-linked stock compensation (Performance Shares) and restricted stock compensation (Restricted Stock) in Europe and the United States, is a system for granting and providing to Eligible Members of the Board or Officers (referred to herein as "delivery" or, as the context requires, "deliver" or "delivered") company shares or funds in amounts equivalent to the conversion price of such shares (the "Company Shares"), in accordance with results and position.

- In order to ensure the transparency and objectivity of determinations related to compensation, NTT has voluntary established the Appointment and Compensation Committee, which consists of four Members of the Board, including two independent outside Members of the Board, as a preliminary review body. The Appointment and Compensation Committee has deliberated upon the adoption of the Compensation System.

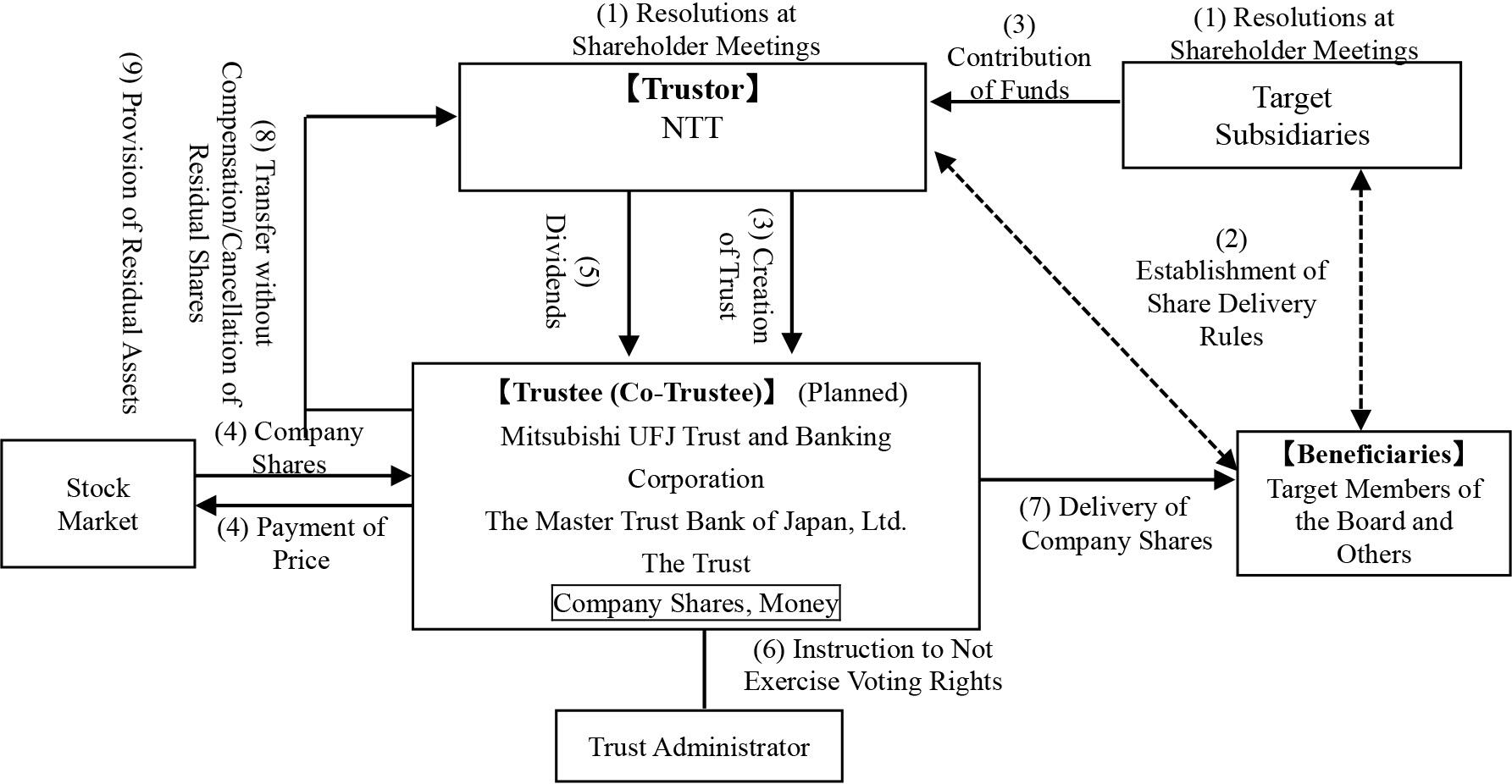

2. Overview of the Compensation System

- Target Companies will obtain approval for the adoption of the Compensation System with respect to each Target Company's respective Members of the Board at the Shareholder Meetings.

- The Board of Directors of each Target Company will establish the share delivery rules of the Compensation System.

- Target Subsidiaries, within the scope approved at each of the Shareholder Meetings referred to in (1) above, will entrust funds to NTT that will constitute the source of the funds for the compensation of the Eligible Members of the Board or Officers of Target Subsidiaries. With the funds entrusted by Target Subsidiaries and the funds that constitute the source of funds for the stock compensation of NTT's Members of the Board or Officers within the scope approved at the Shareholder Meeting referred to in (1) above, NTT will establish the trust under which the Eligible Members of the Board or Officers are beneficiaries.

- Pursuant to instructions from the trust administrator, the trust will acquire the company shares from the stock market with the funds entrusted in (3) above. The number of shares to be acquired by the trust for delivery to the Members of the Board of each Target Company will not exceed the scope approved at the Shareholder Meetings referred to in (1) above.

- Dividends on company shares held by the trust will be paid in the same manner as dividends on other company shares.

- Voting rights for the company shares held by the trust will not be exercised throughout the trust period.

- During the delivery period, Eligible Members of the Board or Officers under the trust will receive certain points pursuant to the stock delivery rules of each Target Company and, if they satisfy the beneficiary requirements, will receive company shares equivalent to a certain ratio of points (with shares less than one unit to be rounded down) from the trust. Company shares equivalent to any residual points will be converted into cash within the trust pursuant to the trust agreement, and Eligible Members of the Board or Officers will receive money equivalent to the converted value of the company shares.

- With respect to any residual shares at the expiration of the trust period due to non-achievement of the company's financial targets or other reasons, in the event that the trust continues to be used under the Compensation System or an equivalent stock compensation system, such shares will be eligible for delivery to the Eligible Members of the Board or Officers. In the event that the trust is terminated upon expiration of the trust period, as a means of shareholder returns, the trust will transfer such shares to NTT without compensation, and it is expected that NTT would cancel such shares pursuant a resolution of the Board of Directors.

- Any residual dividends on company shares held by the trust at the expiration of the trust period will be used as funds to acquire shares if the trust continues to be utilized. In the event that the trust is terminated upon the expiration of the trust period, the amount will be returned to the company within the limits of the trust expense reserve after deducting from the trust money the funds for share acquisition, and the portion exceeding the reserve for trust expenses will be donated to organizations that have no interests with NTT or the Eligible Members of the Board or Officers.

During the trust period, if the number of shares held by the trust is likely to be insufficient for the number of Company Shares equivalent to the number of points to grant shares to the Eligible Members of the Board or Officers (in each case such continuation is referred to herein, the number of points granted as set forth in (5) below), or if the funds consisting of trust assets is likely to be insufficient for the payment of the trust fees and expenses, additional funds may be contributed to the trust within the maximum limit of the trust fund in (7) below, and additional Company Shares may be acquired.

(1)Overview of the Compensation System

The Compensation System will cover the fiscal years that are subject to the medium-term management strategy set forth by NTT (the "Target Period," with the initial Target Period consisting of the remaining period under the current medium-term management strategy, which is the three-fiscal year period from the fiscal year ending on March 31, 2022 to the fiscal year ending on March 31, 2024), and is a system for delivery of Company Shares as executive compensation depending on the position of the Eligible Members of the Board or Officers and the degree to which financial targets under the medium-term management strategy have been achieved, among other factors. Furthermore, in the event of the continuation of the trust thereafter (in each case such continuation is referred to herein, as set forth in Section 4(b) below), the fiscal years that correspond to subsequent medium-term management strategies will be set as the target periods.

(2)Shareholder Meetings with Respect to the Adoption of the Compensation System

Matters including the maximum amount of funds that are to be contributed to the trust for the purposes of acquiring shares for delivery to the Members of the Board, the maximum aggregate amount of Company Shares to be subject to delivery from the trust and other necessary matters will be resolved at the Shareholder Meetings of each Target Company. In the event of the continuation of the trust, with respect to the executive compensation of the Members of the Board of each Target Company who are eligible under the Compensation System, the trust agreement will be amended at the end of the trust period and additional contributions will be made to the trust pursuant to board resolutions, to the extent approval is received at Shareholder Meetings. Furthermore, necessary matters regarding the executive compensation of Executive Officers of each Target Company who are eligible under the Compensation System will also be resolved pursuant to board resolutions.

(3)Persons Eligible for the Compensation System (Beneficiary Requirements)

The Eligible Members of the Board or Officers, subject to meeting the beneficiary requirements described below and upon completing the required beneficiary verification procedures, will be able to have Company Shares delivered from the trust in an amount corresponding to the number of stock delivery points.

The beneficiary requirements are as follows:

- The person is an Eligible Member of the Board or Officer from and after the date the system begins (including persons who newly become Eligible Members of the Board or Officers after the date the system begins)

- The person has retired from the position of an Eligible Member of the Board or Officer* or those who are non-residents of Japan

- The person has not retired due to personal reasons (excluding resignations due to injury, illness or other unavoidable circumstances approved by NTT) or dismissal, and has not engaged in any illegal or inappropriate activities during his or her tenure

- Other requirements that are determined to be necessary to accomplish the purpose of a performance-linked stock compensation system

※However, in the event that the trust period is extended pursuant to Section 4(c) below and such Eligible Member of the Board or Officer is still in office as a person eligible for the system following the expiration of the extended trust period, the trust will be terminated at such time, and delivery of the Company Shares for such eligible person will be conducted while such person remains in office.

(4)Trust Period

a.Initial Trust Period

The three-year period from 2021 to 2024

b.Continuation of the Trust

Upon the expiration of the trust period, the trust may be continued by means of amendment of the trust agreement or creation of an additional trust. In such an event, the number of fiscal years that corresponds to the medium-term management strategy established by NTT at such time will be set as the new target period, the trust period will be extended to correspond to such new target period, and distributions of points to Eligible Members of the Board or Officers will continue to be made during the duration of the extended trust period. For any additional contributions made to the trust during the new target period, executive compensation for Members of the Board of each Target Company will be made within the scope of the maximum amounts of funds to be contributed to the trust that have been approved at the applicable Shareholder Meetings. In the event that such additional contributions are made, however, if there are any Company Shares (excluding Company Shares corresponding to points granted to Eligible Members of the Board or Officers for which Delivery has not been completed) or funds that remain in the trust's property on the last day of the trust period prior to the extension (collectively, "Residual Shares"), the total amount of Residual Shares corresponding to the executive compensation for Members of the Board of each Target Company, plus additional contributions of funds to the trust, will be within the scope of the maximum amounts approved at the applicable Shareholder Meetings. Extensions of the trust period will not be limited to one extension; the trust period may also be re-extended thereafter in the same manner.

c.Expiration of the Trust (Extension of Trust Period without Additional Contributions)

Even in the event that the trust expires, if there are Eligible Members of the Board or Officers who may meet the beneficiary requirements at the time of the expiration of the trust period (or, in the event of a continuation of the trust as described in (b) above, the as-extended trust period), the trust will not be terminated immediately, but rather, the trust period will be extended for a specified limited period of time. In such an event, however, new distributions of points to Eligible Members of the Board or Officers will not be made.

(5)Calculation Method for the Number of Company Shares to be Provided for the Delivery to Eligible Members of the Board or Officers

At a specified time each year during the trust period, points calculated in accordance with the following formula ("Reference Points") will be granted on the basis of the position of each Eligible Member of the Board or Officer. At a specified time following the last day of the final fiscal year of the target period (which is anticipated to be around June 2024 for the initial target period), the number of Company Shares to be delivered will be determined based on the number of Reference Points accumulated during the trust period ("Accumulated Points") multiplied by the performance-linked co-efficient.

The performance-linked co-efficient will be assessed based on financial targets and other metrics set forth in NTT's medium-term management strategy. For the initial target period, the performance-linked co-efficient will be determined within a range of 0-150% at the end of the final fiscal year of the target period (the fiscal year ending March 31, 2024) based on the degree to which financial targets, including EPS growth, have been achieved.

(Reference Point Formula)

Reference stock compensation amount based on position ÷ average closing share price of the company's shares on the Tokyo Stock Exchange in the month prior to the start of the target period (which, for the first target period, will be the month prior to the month in which the trust agreement is entered into) (rounded down to the nearest whole number)

The number of Company Shares that will be subject to delivery to the Eligible Members of the Board or Officers through the trust will be one Company Share per one point, with any fraction less than one point rounded down. If, however, a stock split or reverse stock split occurs with respect to company shares during the trust period, the number of company shares per point will be adjusted in accordance with the stock split ratio or reverse stock split ratio, as applicable.

In addition, in the event that an Eligible Member of the Board or Officer retires or passes away or becomes a non-resident of Japan during the trust period, the number of shares to be delivered will be determined using the number of Accumulated Points as of such time as the number of points for share delivery.

(6)Method of Delivery of the Company Shares to the Eligible Members of the Board or Officers, and Period of Delivery

In the event that an Eligible Member of the Board or Officer who meets the beneficiary requirements retires (excluding instances in which such person passes away), such Eligible Member of the Board or Officer will, upon completing certain specified beneficiary verification procedures, receive company shares from the trust in a number corresponding to a specified percentage of the points for share delivery (rounded down), and with respect to the number of company shares corresponding to the remaining points for share delivery, funds corresponding to the exchange payment will be delivered after such shares are redeemed within the trust. If an Eligible Member of the Board or Officer who meets the beneficiary requirements passes away during the trust period, company shares corresponding to the number of points for share delivery calculated at such time will be redeemed within the trust, and the heirs of such Eligible Member of the Board or Officer will receive a distribution from the trust. If an Eligible Member of the Board or Officer who meets the beneficiary requirements becomes a non-resident of Japan during the trust period, company shares corresponding to the number of points for share delivery calculated at such time will be redeemed within the trust, and the Eligible Member of the Board or Officer will receive a distribution from the trust.

(7)Maximum Total Amount of Funds to be Contributed to the Trust for NTT's Members of the Board or Officers and Maximum Total Amount of Points to be Granted

The maximum total amount of funds to be contributed to the trust for purposes of the acquisition of company shares for delivery to NTT's Members of the Board or Officers, and the maximum total amount of points to be granted to NTT's Members of the Board or Officers, will, subject to being resolved at the Shareholder Meetings, be as described below.

- Maximum Amount of Funds to be Contributed to the Trust(1)

¥0.1 billion for Members of the Board, with the maximum aggregate amount of funds to be contributed to the trust during the target period (three fiscal years) to be ¥0.3 billion. In the event that there is a continuation of the trust as described in Section 4(b) above, the maximum aggregate amount of funds to be contributed to the trust will be an amount equivalent to the maximum amount of trust funds for one fiscal year (¥0.1 billion) multiplied by the number of years in the new target period. - Maximum Total Amount of Points to be Granted to Eligible Members of the Board or Officers(2)

47,000 points per each fiscal year (equivalent to 47,000 shares). Therefore, the maximum aggregate number of company shares to be acquired by the trust will be 141,000 shares, which is the product of the amount per fiscal year multiplied by three (the number of years in the target period). In the event that there is a continuation of the trust as described in Section 4(b) above, the maximum aggregate number of the company shares to be acquired by the trust will be an amount equivalent to the maximum amount of points for one fiscal year (47,000 points) multiplied by the number of years in the new target period.

- Represents the aggregate amount of funds for stock acquisitions by the trust and for trust fees and expenses for the duration of the trust period.

- The maximum total amount of points to be granted to NTT's Members of the Board or Officers is determined based on the maximum amount of trust funds listed above and by reference to the current stock price and other factors.

The Target Subsidiaries as of the time of the start of the system are as follows:

| NTT DOCOMO, Inc. |

| Nippon Telegraph and Telephone East Corporation |

| Nippon Telegraph and Telephone West Corporation |

| NTT Communications Corporation |

| NTT Urban Solutions, Inc. |

| NTT, Inc. |

(8)Method of Acquisition of Company Shares by the Trust

Initial company shares acquired by the trust are anticipated to be acquired from the stock market.

Acquisitions of company shares with respect to NTT's Eligible Members of the Board or Officers will be conducted in an amount of shares within the scope that corresponds to the maximum total amount of acquisition funds and maximum total amount of points granted to the Members of the Board or Officers described in (7) above.

(9)Clawback System

A system will be established such that, in the event that an Eligible Member of the Board or Officer engages in significant illegal or inappropriate activity, or takes employment at another company in the same industry without the permission of the company, the system will enable the revocation of rights to receive Company Shares under the Compensation System with respect to such person (malus clause) and the request for the return of funds corresponding to previously delivered Company Shares (clawback).

(10)Exercise of Voting Rights of Company Shares within the Trust

In order to maintain the neutrality of management, voting rights with respect to company shares held within the trust (i.e., company shares held before delivery to the Target Members of the Board and Officers as described in (6) above) will not be exercised during the trust period.

(11)Dividends on Company Shares within the Trust

Dividends on company shares held within the trust will be received by the trust and applied to the trust's fees and expenses.

(12)Expiration of the Trust Period

With respect to any residual shares at the expiration of the trust period due to non-achievement of the company's financial targets or other reasons, in the event that the trust continues to be used under the Compensation System or an equivalent stock compensation system, such shares will be eligible for delivery to the Eligible Members of the Board or Officers. In the event that the trust is terminated upon expiration of the trust period, as a means of shareholder returns, the trust will transfer such shares to NTT without compensation, and it is expected that NTT would cancel such shares pursuant a resolution of the Board of Directors.

In addition, any residual dividends on the company shares held by the trust that exist at the expiration of the trust period will be used as funds to acquire shares if the trust will continue to be used. If, however, the trust is terminated due to the expiration of the trust period, the residual dividends will vest in NTT within the extent of reserves for trust expenses, which are calculated by deducting funds for acquiring shares from the trust money, and the portion exceeding the reserves for trust expenses will be donated to organizations that have no interests with NTT or the Eligible Members of the Board or Officers.

(Reference)

Details of the Trust Agreement

| (1) Type of Trust: | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) |

| (2) Purpose of Trust: | Providing incentives to the Eligible Members of the Board or Officers |

| (3) Trustor: | NTT |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (planned) (Co-Trustee: The Master Trust Bank of Japan, Ltd. (planned)) |

| (5) Beneficiaries: | Eligible Members of the Board or Officers who satisfy the beneficiary requirements |

| (6) Trust Administrator: | Third party with no interests with NTT (certified public accountant) |

| (7) Exercise of Voting Rights: | No voting rights will be exercised. |

| (8) Type of Shares to be Acquired: | Shares of NTT's common stock |

| (9) Method of Share Acquisitions: | Acquisitions from the stock market * Additional details, including the time period for acquisitions, are expected to be determined and disclosed by NTT following the resolution of the General Meeting of Shareholders. |

| (10) Rights Holder: | NTT |

| (11) Residual Assets: | The residual assets that NTT, as the rights holder, may receive will be within the extent of reserves for trust expenses, which are calculated by deducting funds to acquire shares from the trust funds. |

Nippon Telegraph and Telephone Corporation

Executive Compensation Policy

1. Fundamental Policy of the Executive Compensation Policy

The vision of NTT Group is to, as "Your Value Partner," leverage its research and development, ICT infrastructure, human resources and other management resources and capabilities, collaborate with its partners, and promote digital transformation with the aim of resolving social issues through its business activities.

In order to achieve such a vision, the executive compensation system is an important mechanism for increasing motivation by strongly encouraging the execution of responsibilities by executive officers in furtherance of increasing medium- to long-term corporate value and achieving sustainable growth.

2. Compensation Principles

The level of executive compensation will take into considerations factors including economic and social conditions, the business environment of NTT Group, a review of compensation levels of comparably sized major companies based on external databases and other data, and the responsibilities of officers of NTT and NTT Group companies, and will be determined upon review of appropriate levels to be able to maintain market competitiveness.

3. Details of Compensation Structure and Performance-Linked Compensation (Planned to be Adopted Beginning the Fiscal Year Ending March 31, 2022 for the Executive Compensation System)

The new executive compensation system, beginning in the fiscal year ending March 31, 2022, will adopt a performance-linked compensation system as a medium- to long-term incentive, and is designed to increase the ratio of performance-linked compensation compared to the current system. As a result, compensation for Members of the Board (excluding outside Members of the Board) and Executive Officers will consist of base monthly salaries, bonuses and stock compensation. In addition, Executive Officers will make contributions of certain defined amounts or more for the purchase of NTT shares through the officer shareholding association.

The composition ratio of compensation in the event that standard business results are achieved will roughly be as follows: monthly base salary : short-term incentive (bonus) : medium- to long-term incentive (stock acquisition funds and performance-linked stock compensation) = 50:30:20, and the ratio of performance-linked compensation will increase from the current 30% to 50%.

Details of each compensation system are described below.

• Monthly Base Salary

Monetary compensation to be paid based on the significance of each executive officer's role and the scope of such officer's responsibilities, as a fixed monthly salary

• Bonus (Short-Term Incentive)

- Performance-linked monetary compensation paid each year in June upon consideration of business results in the current fiscal year

- With respect to the financial targets for bonuses, the targets set forth in the medium-term management strategy are used as the relevant indexes upon which evaluations are made

• Stock Acquisition Funds (Medium- to Long-Term Incentive)

- Funds to purchase NTT treasury shares through the officer shareholding association using contributions of certain defined amounts or more

- All NTT treasury shares purchased with such funds will continue to be held during the period of tenure of such Executive Officers, with the purpose of further promoting profit-sharing with shareholders by promoting the holding of NTT shares by Executive Officers

• Performance-Linked Compensation (Medium- to Long-Term Incentive)

- Performance-linked stock compensation that varies based on the degree to which business performance targets, including the financial targets set forth in NTT's medium-term management strategy, have been achieved during the fiscal years covered by the medium-term management strategy

- Creates a clear correlation between executive compensation and the corporate value of the company for the purpose of providing increased incentive to achieve the financial targets set forth in the medium-term management strategy, and further promotes profit-sharing with shareholders by advancing the ownership by Executive Officers of the stock of the company, in order to work towards the achievement of the medium-term management strategy

- Using the trust established by NTT, points are granted and accumulated each year as determined in accordance with position, and upon the expiration of the medium-term management strategy, the number of shares to be granted is calculated by multiplying the performance-linked co-efficient, based on the degree to which financial targets have been achieved, by the number of accumulated points. EPS growth, among other targets, will be used as the financial targets for stock compensation, and shares will be granted upon the retirement of the Executive Officer.

- If an Executive Officers who is eligible for the stock compensation system commits a significant violation of his or her contract with the company or engages in other inappropriate activity, or takes employment at another company in the same industry without the permission of the company, the system will enable the revocation of rights to receive grants of company shares under the Compensation System with respect to such person (malus clause) and the request for the return of funds corresponding to previously delivered NTT shares (clawback).

※NTT plans to submit for approval a proposal relating to the adoption of the Compensation System at the 36th Ordinary General Meeting of Shareholders of NTT scheduled to be convened on June 24, 2021, and the adoption of the Compensation System is subject to approval of the proposal.

In order to maintain a high level of independence, compensation of outside Members of the Board consists of a base salary only, and is not linked to NTT's business results. Compensation of Audit & Supervisory Board Members is determined by resolution of the Audit & Supervisory Board and consists of a base salary only, for the same reasons as those cited above with respect to outside Members of the Board.

4. Process of Determining Compensation

With regard to the compensation of Members of the Board of NTT, in order to ensure objectivity and transparency, NTT established the Appointment and Compensation Committee, which consists of four Members of the Board, including two outside independent Members of the Board, and the committee makes compensation determinations including with respect to individual compensation. In addition, the Board of Directors has delegated determinations regarding the compensation ratio, the compensation calculation method and individual compensation to the committee.

Information is current as of the date of issue of the individual press release.

Please be advised that information may be outdated after that point.

NTT STORY

WEB media that thinks about the future with NTT