Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

November 4, 2025

NTT, Inc.

NOTICE REGARDING THE INTRODUCTION OF A STOCK-GRANTING SYSTEM FOR GROUP EMPLOYEES

NTT, Inc. ("NTT") hereby announces that it has decided today to introduce a new stock-granting system (the "System") for managerial employees (the "Target Employees") at NTT and NTT's specified major group companies (the "Target Subsidiaries") who meet certain requirements, and to establish a stock-granting ESOP Trust (the "ESOP Trust") as outlined below.

1. Purpose of Introducing the System

- In its Medium-Term Management Strategy "New Value Creation & Sustainability 2027 Powered by IOWN," announced in May 2023, the NTT Group set out the pillars of "NTT as a creator of new value and accelerator of a global sustainable society," "upgrading the customer experience (CX)," and "improving the employee experience (EX)," and aims to improve corporate value by placing support for global sustainability at the core of its business and balancing the creation of new value to that end with the NTT Group's sustainable business growth and development. Towards the realization of the Medium-Term Management Strategy, NTT has decided to introduce the System with the aim of increasing Target Employees' awareness of their participation in management and further enhancing their motivation and engagement to contribute to improving business performance, thereby increasing NTT's medium- to long-term corporate value.

- The introduction of the System will enable the Target Employees to enjoy the economic benefits of NTT's rising stock price, and is expected to encourage the Target Employees to take the stock price into consideration when performing their duties and to increase their motivation to work.

2. Overview of the System

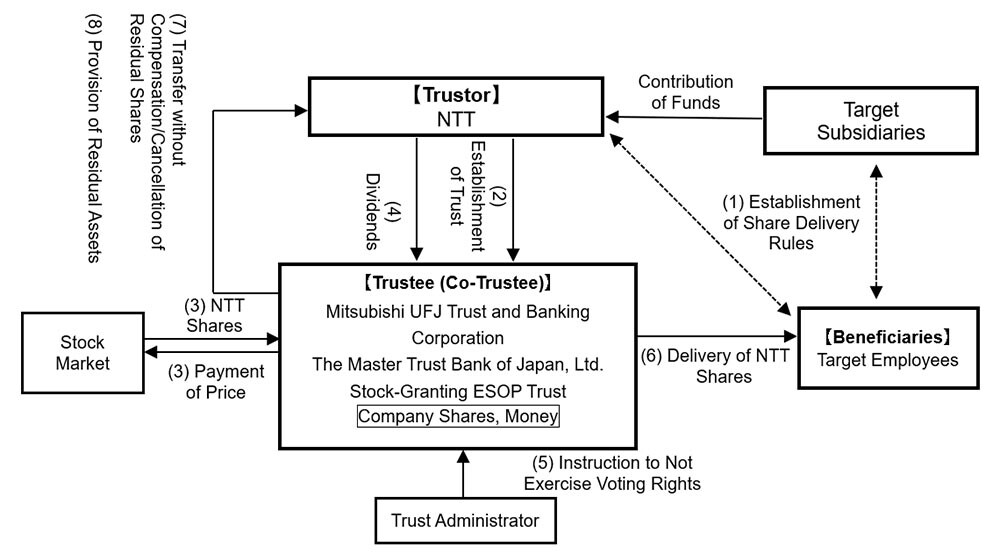

The System will adopt a structure known as a stock-granting Employee Stock Ownership Plan (ESOP) Trust. The ESOP Trust is an incentive plan modeled after the US ESOP system, and NTT shares acquired by the ESOP Trust will be granted to Target Employees who meet certain requirements in accordance with pre-determined share delivery rules. The acquisition funds for the NTT shares acquired by the ESOP Trust will be contributed by NTT and its group companies, so there will be no burden on Target Employees.

- NTT and the Target Subsidiaries will establish share delivery rules when implementing the System.

- NTT will entrust a certain amount of money to a Trustee and establish an ESOP trust (the "Trust") with the Target Employees as the beneficiaries.

- Pursuant to the Trust Administrator's instructions, the Trust will acquire NTT shares from the stock market using the funds contributed in ②.

- Dividends on NTT shares held by the Trust will be paid in the same manner as dividends on other NTT shares.

- Voting rights for the NTT shares held by the Trust will not be exercised throughout the trust period.

- During the trust period, the Target Employees will be granted and accumulate certain points in accordance with the share delivery rules of NTT and the Target Subsidiaries. The Target Employees who meet certain requirements will be granted NTT shares corresponding to the accumulated points. Each Target Subsidiary will settle with NTT in cash equivalent to the NTT shares granted to respective Target Employees.

- With respect to any residual shares at the expiration of the trust period, in the event that the Trust continues to be used under the System or an equivalent stock compensation system, such shares will be eligible for delivery to the Target Employees. In the event that the Trust is terminated upon expiration of the trust period, as a means of shareholder returns, the Trust will transfer such shares to NTT without compensation, and it is expected that NTT would cancel such shares pursuant a resolution of the Board of Directors.

- Any residual dividends on the NTT shares held by the Trust at the expiration of the trust period will be used as funds to acquire shares if the Trust continues to be utilized. In the event that the Trust is terminated upon the expiration of the trust period, the amount will be returned to NTT will be within the limits of the trust expense reserve after deducting the funds for share acquisition from the trust money, and the portion exceeding the reserve for trust expenses will be donated to organizations that have no interests with NTT or the Target Subsidiaries.

*During the trust period, if the number of shares held by the Trust is likely to be insufficient, or if the funds consisting of trust assets is likely to be insufficient for the payment of the trust fees and expenses, additional funds may be contributed to the Trust.

Reference:

Details of the Trust Agreement

| (1) Type of Trust: | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) |

|---|---|

| (2) Purpose of Trust: | Providing incentives to Target Employees |

| (3) Trustor: | NTT |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Co-Trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Target Employees who satisfy the beneficiary requirements |

| (6) Trust Administrator: | Third party with no interests with NTT (certified public accountant) |

| (7) Exercise of Voting Rights: | No voting rights will be exercised. |

| (8) Trust Agreement Date: | November 7, 2025 (planned) |

| (9) Trust Agreement Term: | November 7, 2025 (planned) to August 31, 2028 |

| (10) System Start Date: | November 7, 2025 (planned) |

| (11) Type of Shares to be Acquired: | Shares of NTT's common stock |

| (12) Trust Fund Amount: | 4.9 billion yen (planned) (including trust fees and expenses) |

| (13) Share Acquisition Period: | From November 12, 2025 to November 28, 2025 (planned) (excluding the period from the fifth business day prior to the last day of the accounting period (including semiannual and quarterly accounting periods) to the last day of the accounting period). |

| (14) Method of Share Acquisitions: | Acquisitions from the stock market |

| (15) Rights Holder: | NTT |

| (16) Residual Assets: | The residual assets that NTT, as the rights holder, may receive will be within the extent of reserves for trust expenses, which are calculated by deducting funds to acquire shares from the trust funds. |

Note: The timing scheduled above may be changed to appropriate times in light of applicable laws and regulations.

End

For further inquiries, please contact:

Terajima or Ooshima

Investor Relations Office

Finance and Accounting Department

NTT, Inc.

Contact us by email:

https://group.ntt/en/ir/contact/

Information is current as of the date of issue of the individual press release.

Please be advised that information may be outdated after that point.

NTT STORY

WEB media that thinks about the future with NTT