Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

When you select a year, you can see the list of articles for the selected year.

May 10, 2024

CEO Press Conference

Financial Results for the Fourth Quarter of FY2023 ended March 31, 2024

Akira Shimada, President and CEO, Representative Member of the Board

(Attendees)

Toshihiko Nakamura, Senior Vice President, Head of Finance and Accounting

Akitoshi Hattori, Senior Vice President, Head of Corporate Strategy Planning

(President Shimada)

I would like to explain our financial results for fiscal 2023 and our financial forecast for fiscal 2024.

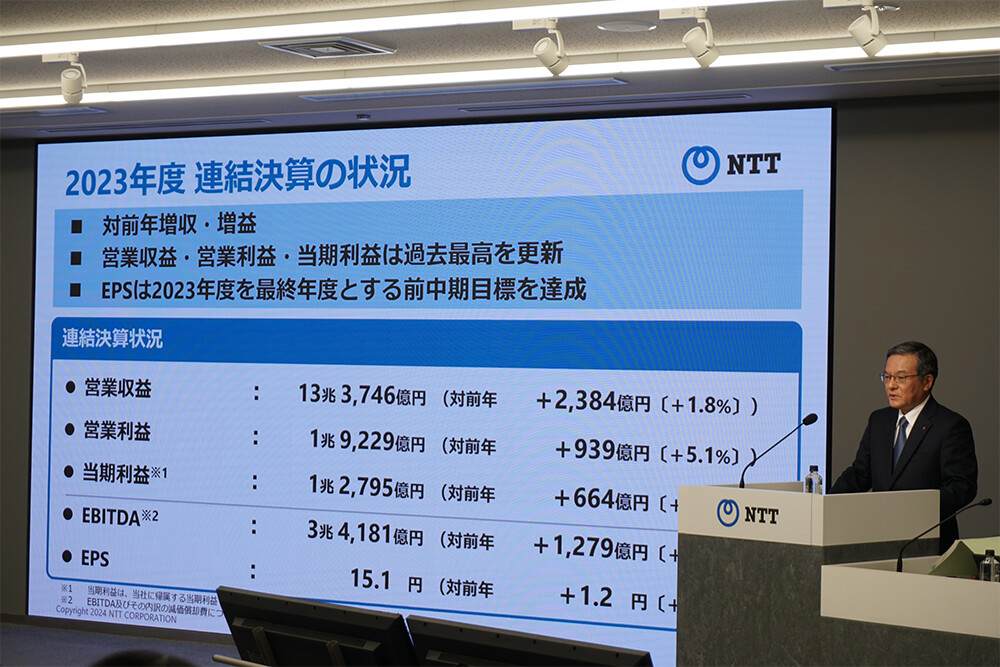

Please refer to page 4. Consolidated financial results for fiscal 2023 showed record highs and year-on-year increase in, operating revenue, operating profit, and profit.

Operating revenue increased by ¥238.4 billion year-on-year to ¥13,374.6 billion, despite a decrease of approximately ¥260 billion in electricity revenue at Ennet. Of this increase in sales, the impact of foreign exchange rates was approximately ¥200 billion.

Operating profit increased by ¥93.9 billion year-on-year to ¥1,922.9 billion, despite a decrease in profit due to increases in disaster recovery and security-related expenses, due to cost reductions, and an increase in profit through streamlining of non-core assets.

Net profit increased by ¥66.4 billion year-on-year to ¥1,279.5 billion, mainly due to an increase in operating profit. EBITDA increased by ¥127.9 billion year-on-year to ¥3,418.1 billion due to an increase in operating profit. EPS is ¥15.1, achieving the previous medium-term financial target of ¥14.8, which is set to end in fiscal 2023.

Please refer to page 5. This is about revenue and profit by segment. As for the comprehensive ICT business segment, sales and profits increased year-on-year due to the expansion of integrated solutions in the corporate business, the asset effect created by the reorganization, and the growth centered on finance and settlement in the Smart Life business.

In the regional communications business segment, despite a decrease in profit due to increased disaster recovery and security-related expenses, revenue and profit increased year-on-year due to cost reductions and profit growth through streamlining of non-core assets.

For global solutions business segment. In addition to higher sales in the public, financial, and corporate sectors in Japan, the impact of foreign exchange rates and other factors contributed to year-on-year increases in sales. Operating profit increased year-on-year due to higher operating profit.

In the others (real estate, energy, etc.) segment, NTT Anode Energy recorded a year-on-year decrease in revenue due to a decrease in electricity revenue resulting from a reduction in the amount of electricity procured in response to rising electricity procurement prices. In terms of profit, we had a profit in the previous fiscal year due to low power procurement prices, but in fiscal 2023, profit decreased from the previous year due to the impact of higher power procurement prices.

Please refer to page 7. This is the forecast for fiscal 2024. Operating revenue increased year-on-year while operating profit and net profit decreased year-on-year. Operating revenue was negatively impacted by the foreign exchange rates by approximately ¥130 billion, but we aim to achieve record highs thanks to increased revenue in the comprehensive ICT business segment and the global solutions business segment.

Operating profit and EBITDA are expected to decrease year-on-year but excluding temporary factors such as the effect of streamlining non-core assets in fiscal 2023, operating profit and EBITDA are expected to increase.

We believe that fiscal 2024 will be the year in which we will implement various measures to achieve the targets set forth in our new medium-term management strategy for fiscal 2027, and we will actively implement measures to expand medium-term profit while increasing base profit.

Please refer to page 8. Revenue and profits by segment are expected to increase year-on-year due to the continued expansion of integrated solutions in the comprehensive ICT business segment and an increase in corporate business.

In the regional communications business segment, sales and profits declined year-on-year due to a rebound from the streamlining of non-core assets in fiscal 2023 and an increase in disaster recovery costs, as well as continuing declines in fixed voice revenue and IP and packet communications revenue. However, we will work to reverse the year-on-year increase in profits in fiscal 2025 and achieve medium-term growth through cost reduction measures such as business selection and concentration and operational efficiency.

In the Global Solutions Business Segment, we plan to increase revenue and profit year-on-year due to continued growth in sales driven by demand for digitalization.

The other (real estate, energy, etc.) segment. NTT Urban Solutions recorded an increase in revenue and a decrease in profit compared to the previous year due to a reactionary decrease in profit from the sale of properties in the previous year, despite an increase in revenue due to the expansion of housing sales.

Please refer to page 9. I will explain our current profit level and our efforts to achieve our medium-term targets. The NTT Group has been actively striving to streamline its non-core assets in order to achieve the goals of the previous medium-term management strategy ending in fiscal 2023. As a result, we achieved our EPS target and a substantial increase in profit in fiscal 2023.

Although there will be a temporary decrease in profit in fiscal 2024, we intend to proactively develop measures to achieve our medium-term targets for fiscal 2027 while increasing profit excluding special factors such as streamlining non-core assets. Specifically, we aim to achieve a 20% increase in EBITDA in fiscal 2027 from the fiscal 2022 level by maximizing returns by aggressively investing in growth fields, strengthening corporate businesses in Japan and overseas by taking advantage of synergies from the integration of DOCOMO and NTT DATA, and implementing fundamental cost structure reforms for the entire NTT Group.

Please refer to page 10. I would like to add one point to this financial result. As you can see, the amount on the balance sheet has increased, mostly due to the expansion of the financial business and data center business, which are positioned as growth areas in the medium-term management strategy. Since these businesses have different business and financial characteristics from the telecommunications business, which is the core of our existing business, we have created a system to show them separately so that stakeholders can use them to evaluate corporate value and creditworthiness.

For the data center business, in addition to assets and liabilities, EBITDA, operating revenue, and operating profit have been disclosed in the supplementary materials for financial results since fiscal 2023. In the financial services business, we will enhance the disclosure of the balance sheets of our new consolidated subsidiaries, Monex Inc. and ORIX Credit Corporation, by the end of fiscal 2024.

Please refer to page 11. I will explain about shareholder returns. At today's Board meeting, we discussed that the dividend for fiscal 2023 will be ¥2.6 per share, an increase of ¥0.1 from the initial dividend forecast and that the annual dividend forecast for fiscal 2024 will be ¥5.2, an increase of ¥0.1 from the previous year. As a result, we plan to increase dividends for 14 consecutive fiscal years beginning in fiscal 2011.

Please refer to page 12. Next, I will explain the topics.

First, I would like to explain the establishment of NTT DOCOMO Global. A new company will be established in July to oversee global business within the NTT DOCOMO Group and to promote business in an integrated and flexible manner across businesses. NTT Digital, Inc. and OREX SAI, Inc., and the NTT Group will expand its business around the overseas expansion of application services such as Web3, and support the introduction of Open RAN for overseas telecommunications carriers, with the aim of realizing a richer life and society for customers around the world.

Please refer to page 14. Next, I would like to explain the establishment of NTT Precision Medicine. Precision medicine refers to a medical concept that provides personalized, optimal prevention and medical care. To achieve this, it is necessary to collect, analyze, and utilize medical healthcare data such as clinical data and laboratory data linked to individuals in an integrated manner. Therefore, we have decided to establish NTT Precision Medicine Corporation., which integrates the assets and resources of each company in the NTT Group to provide a one-stop solution for data generation and utilization. We intend to take on the challenge of this project in cooperation with our stakeholders.

Please refer to page 15. Let me explain the appointment of Chief Customer Experience Officer ("CCXO") and Chief Artificial Intelligence Officer ("CAIO"). To strengthen CX and customer experience, we will appoint a new CCXO at major NTT Group companies. At the same time, we will reflect customer engagement indicators in the performance-linked compensation of executives.

To further promote the AI-first strategy, the holding company will appoint two new CAIO.

Please refer to page 16. I will explain how to achieve net zero by 2040. In fiscal 2023, with scope 1 and 2 emission being 2.42 million tons, we are on track to exceed the target. In addition, we have already announced our net zero target for 2040 in our new medium-term management strategy, and we are aiming for a 40% reduction in scope 1, 2, and 3 to 17 million tons in fiscal 2030 as an interim target.

Please refer to page 17. Next, I would like to explain IOWN's efforts for overseas business development. Upgrade 2024 was held in San Francisco. In order to implement IOWN and other social technologies globally, we have carried out research and development results and product development proposals for distributed data centers using APN, tsuzumi, etc., and have received numerous media reports in Japan and overseas.

Please refer to page 18. Next, I will explain the status of the number of shareholders. As of the end of March, the number of shareholders had increased slightly in the past but continued to increase since the announcement of the stock split, doubling from 1 year ago to 1.86 million. The age structure is also diversifying, with the proportion of people in their 40s or younger increasing by four times.

Please refer to page 19. The progress of the new medium-term management strategy since February is shown below. That's all for my explanation.

Q&A

-

Please tell us your evaluation of the new presidents of NTT DOCOMO, NTT Communications, and NTT Data Group, as well as the roles and expectations of the three new presidents.

First, the age of the presidents will be much younger. Mr. Maeda of NTT DOCOMO is 54 years old, Mr. Kojima of NTT Communications and Mr. Sasaki of the NTT Data Group are 58 years old. They are all presidents in their 50s. I want the new generation to build the next strategy.

Mr. Maeda of NTT DOCOMO has led the Smart Life business, and NTT DOCOMO will continue to take on challenges in new business fields such as Smart Life and global. In that sense, it is extremely important that Mr. Maeda, who has been the driving force behind new businesses, take a further leap forward.

Mr. Kojima of NTT Communications has been involved in corporate sales for a long time. In recent years, he has been actively promoting integrated solutions, especially solutions integrated with mobile devices, as well as security, etc., and he has a good track record. I'm hopeful that the right person will become president.

Mr. Sasaki of NTT DATA Group is already the president of NTT DATA in Japan, and the growth of NTT DATA in Japan is excellent in this financial results, and it is growing in all fields. As for NTT DATA, Inc., the CEO is Abhijit Dubey, and Mr. Sasaki is also very close to him, so I think he is a suitable person to lead the entire company. All three have very high expectations from me. -

What do you think about the special assets, restrictions on foreign investment, and universal service that other companies often talk about in discussions on the NTT Law? In particular, SoftBank President Miyagawa has been saying that "optical fiber, not cellular communication lines, should be universal service." I would like to hear your thoughts on the future of universal service.

In discussing the NTT Law, there are three working areas within the Ministry of Internal Affairs and Communications, but I think the most important one is how to achieve universal service. In order to promote discussion, NTT presents the scale of the cost burden of providing mobile and optical services. For example, there are several options, such as about ¥77 billion in the red if you cover everything with optical line, and about ¥3 billion in the red if you also use mobile and use home phone.

I think it is important for experts to look at these basic data and sort them out in terms of both economic rationality and benefits.

Of course, some assumptions are attached to the calculation, so the working group asked us to explain the basis of the calculation. I have already explained this, so I believe that discussions will progress in detail. I believe it is important for experts to see these basic data and sort out both the economic rationale and the benefits.

An optical line is one option, but it would cost a lot, so NTT believes that it would be more economically rational to combine optical lines or organize them in a way that makes extensive use of mobile networks.

I believe that most of you work on mobile phones, and most Japanese people use mobile phones every day to make phone calls and send emails, so I think it is desirable that consideration be advanced based on these usage conditions. After the discussion on universal service has been decided, we should consider other issues such as fair competition and regulation of foreign investment.

However, regarding restrictions on foreign investment, it seems that conservative discussions are proceeding with the stance that people in various positions do not want to change their stance. I hope that discussions will proceed without wavering on the axis of what should be protected as Japan. I don't think there will be any change in the world if we keep thinking conservatively, so I think we should discuss how things should be.

As for fair competition, the content is basically established in the Telecommunications Business Law, so NTT will continue to respond to this matter. As for mobile carriers, we will install optical fiber from NTT EAST and NTT WEST not only in areas where they provide services, but also in areas where they do not provide services if requested, so we will continue to respond to this matter. -

The Chairman, Sawada seems to be stepping down from representative of the Board, but what is the purpose and intent of his decision?

In 2018, then-President Sawada formulated the previous medium-term management strategy, but in fiscal 2023 we achieved EPS, which was the main indicator, and reached a milestone. This time, he said that he would like to step down from the representative authority, and the decision was made after discussions at the Nomination Committee and the Board.

-

Within the NTT Group, the overseas business is concentrated in the NTT Data Group. I would like to know the concept of the group formation, whether the collaboration and synergy between NTT DOCOMO Global and the NTT Data Group are in view, or whether NTT DOCOMO Global will seek growth separately from the NTT Data Group as a global business for consumers.

The background to the decision to create NTT DOCOMO Global is that while NTT DATA, Inc., is developing a BtoB business, the human resources required for developing a new consumer-related business are completely different. Therefore, we have been searching for a way to successfully develop a BtoC and BtoBtoC business at NTT DOCOMO, which has been working hard in Japan in the consumer-related business.

Now that we are finally launching our Web3 business, I would like to expand our BtoC business further. -

Regarding the appointment of the president of NTT DOCOMO, Mr. Maeda is said to be the first president who was a mid-career hire. What does this mean for the company?

I don't think in terms of mid-career hire or new graduate hire. President Ii of NTT DOCOMO had the same idea. Within the holding company, for example, Mr. Katsuyama, Executive Officer of the Global Business Division, who used to work at NTT, once left the company and returned to the NTT Group. The number of mid-career hires within the NTT Group is also increasing, accounting for nearly 40% of all hires.

Therefore, it is quite possible that mid-career employees will continue to become top management and executives. In that sense, the fact that Mr. Maeda is leading NTT DOCOMO from now on is a major symbolic appointment. -

The NTT Group has a history of struggling to expand overseas, but what is the significance and background of taking this opportunity to re-shape and expand overseas, as well as the purpose of creating a new company?

Basically, I think we need to renew the system. If NTT DATA, Inc.'s resources are available, it would be faster to use them. However, in the consumer field, we need to recruit different human resources to develop our business.

For example, the payment business in Southeast Asia is handled by NTT DATA in Japan, not NTT DATA, Inc. Because the capabilities required are different in each business field, each area of expertise, and ultimately the skills of the people, we have decided that it would be more efficient to create a separate business entity.

In the future, when the business grows and there are overlapping efforts, we will sort them out again. I hope that each team will take on challenges and grow our global business. -

What is the current status of the revised NTT Law, such as the abolition of the obligation to disclose research results and the appointment of foreign executives, as well as the impact on the field? In particular, since it will be possible to change the official name of the company, any possibility of a name change from "Nippon Telegraph and Telephone"?

First of all, I am very grateful for the lifting of the obligation to disclose R&D. I hope that this will lead to further progress in partnering.

Also, foreign directors are not included in the agenda for this year's general meeting. The process of selecting directors takes quite a long time. For example, we have gone through various processes since last summer to select the new external board members. I would like to continue to select the best people for next year.

Also, I am grateful that the approval of directors has already been implemented, so at the end of this year's general meeting of shareholders, we won't have to say that "approval from the Minister of Internal Affairs and Communications is required."

Lastly, I cannot say anything about the change of the company name at this stage, but I will think carefully about where to take the brand as it is very important. If we were to change it, we would have to submit it to the General Meeting of Shareholders, so we would like to consider it around next year. -

The House of Councillors has just passed a bill to introduce a security clearance system limited to those who are authorized by the government to handle important secrets related to economic security. Please tell us your reaction to the system, your outlook on its impact on your company, and your current or future actions.

We have been advocating that security clearances be properly designed. For example, NTT participates in security discussions by the U.S. government, private organizations, and associations, but at this point, various information shared there is not allowed to be shared within Japan.

I would like to say that I have high hopes for the sharing of security clearance rules between Japan and the United States, and the creation of a system that enables information sharing in the same way. -

Regarding the financial business, NTT DOCOMO is currently in charge of a large part of the business. I would like to know what kind of formation the NTT Group will take and what specific plans it has for other financial fields including banking.

Alliances in securities, loans, and insurance are steadily advancing. In the financial sector, I believe it should be handled by NTT DOCOMO for the most part. Of course, there are NTT Group companies such as NTT Data that have powerful capabilities in the systems that support them, so we will be working with them, but NTT DOCOMO will be working with customers.

I would like to further expand the financial business, so please stay tuned. -

In the forecast for the next fiscal year, while operating cost is almost flat, and operating cost is falling considerably. What is the cause of this result?

Regarding the financial forecast for the next 12 months, first of all, operating revenue is about ¥130 billion lower because we expect the yen to appreciate. Excluding the impact of foreign exchange rates, revenue increased by more than ¥200 billion. Depending on the exchange rate, it may be unclear.

The reason for the decline in operating profit by approximately ¥100 billion is that NTT has been gradually transferring redevelopable assets to NTT Urban Development for redevelopment. However, NTT Urban Development has been taking measures to remove or remove buildings that were determined not to be eligible for development, unnecessary assets such as radio relay stations that NTT previously owned, and land for communication office buildings that are no longer needed to improve asset efficiency as a result of the integration of NTT DOCOMO and NTT Communications. This resulted in the final sale of these buildings in FY 2023, resulting in a reaction.

Net profit decreased by ¥179.5 billion, but this was a reaction to the sale of IIJ shares, and was negatively affected by such temporary fluctuation factors in the previous fiscal year. In addition, in fiscal 2024, NTT EAST and NTT WEST are planning to take measures to deal with aging facilities and to record expenses to further improve costs. So, the plan is to crouch down and make a jump from there. -

As inflation continues, a virtuous cycle of cost pass-through and raising wages is desirable, but it is difficult in the industry that raising service fees will directly lead to a burden on the public. The government has decided to raise wages to a certain extent this fiscal year, but amid continuing inflation, what are your thoughts on raising wages and cost pass-through?

Of course, we will raise wages. In terms of the environment, NTT EAST and NTT WEST, for example, have seen a decrease in the number of landlines, and optical lines have been sluggish, and the environment is becoming severe. NTT DOCOMO is also in a competitive environment, so I think it is difficult to raise the service fee easily. While gaining your understanding, we would like to consider raising the fee when necessary, but at this stage we are not considering it.

Corporate

NTT Group Medium-Term Management Strategy

New Value Creation & Sustainability 2027 Powered by IOWN

We announced our new NTT Group medium-term management strategy which is based on the fundamental principle "Innovating a Sustainable Future for People and Planet" in May 2023

NTT STORY

WEB media that thinks about the future with NTT