Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

FY2019.1Q Financial Results-Key Points

Last updated : August 9, 2019

- FY2019.1Q resulted operating revenue increase and operating income decrease, as it is progressing above our business plan.

- Resolved to buy back shares (Up to 300.0 billion yen) to be acquired from the Japanese government.

-

The amount of treasury stock purchased this fiscal year already exceeds the previous year. Will any additional share buy-backs be planned in the second half of FY2019?

Although it is undecided at this time, it would be conducted flexibly by taking into consideration the business trends.

The total shareholder return ratio for this term is expected to be about 100% due to the acquisition of treasury stock, and we will continue to enhance shareholder returns.

-

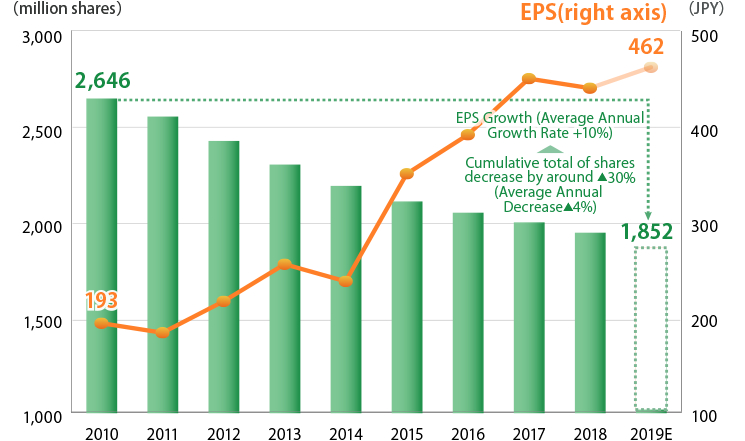

Buy-back of treasury stocks have been actively conducted every year, but how much shares have been purchased so far?

We have acquired treasury stock strategically and continuously, and although there are differences in scale depending on the fiscal year, we have acquired approximately 30% of the number of issued shares in the past 10 years. It contributes to EPS Growth (Average Annual Growth Rate is 10%).

Changes in EPS and Outstanding Shares

(Note)Number of shares outstanding : Weighted average number of shares outstanding, excluding treasury stock

-

How are the global business performance positioned as a growth business domain?

Revenue has increased by 1 billion USD from last year due to the growth of NTT Group Companies. The integration of NTT communications, Dimension Data, NTT Security is proceeding to enhance competitiveness of global business and foreign sales are raising steadily.

For profit margin, ▲1.0pt decreased from last year due to the expenditures of promotions for enhancement of brand value. Excluding this expenditures, it is as same level as last year.

-

The subscribers of new billing plan fro NTT DOCOMO in the first quarter were below expectations. Isn't the annual plan for operating profit going up?

The subscribers of new billing plan are slightly less but it is progressing under our expectations.

Although the impact of the decline in profits is expected to increase due to the increase in subscribers to the new billing plan, each group company will work to exceed the annual business plan by thoroughly improving operational efficiency.

IR Events · Presentations

- Announcement of New Price Plans of NTT docomo

- FY2018.4Q Financial Results-Key Points

- FY2019.1Q Financial Results-Key Points

- FY2019.2Q Financial Results-Key Points

- FY2019.3Q Financial Results-Key Points

- FY2019.4Q Financial Results-Key Points

- FY2020.1Q Financial Results-Key Points

- Frequently Asked Questions

- FY2020.2Q Financial Results-Key Points

- FY2020.3Q Financial Results-Key Points

- FY2020.4Q Financial Results-Key Points

- FY2021.1Q Financial Results-Key Points

- FY2021.2Q Financial Results-Key Points

- FY2021.3Q Financial Results-Key Points

- 2021.4Q Financial Results : Key Points

- 2022.1Q Financial Results : Key Points

- 2022.2Q Financial Results : Key Points

- FY2022.3Q Financial Results : Key Points

- FY2022 Financial Results: Key Points

- 2023.1Q Financial Results : Key Points

- 2023.2Q Financial Results : Key Points

- 2023.3Q Financial Results : Key Points

- 2023.4Q Financial Results : Key Points

IR Library

Investor Relations

Stock Price (Real Time)

- TSE Prime : 9432

Last -

Change -

NTT STORY

WEB media that thinks about the future with NTT