Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

FY2020.2Q Financial Results-Key Points

Last updated : November 11, 2020

- FY2020 2Q operating revenues decreased, while operating income increased. As a result of the impact of COVID-19 and other factors, operating revenues decreased by 178.2 billion yen (a decrease of 3.0%) from the previous year, but due to an increase in operating income at NTT DOCOMO's Smart Life business, improved overseas earnings and other factors, operating income shifted from a decrease of 7.6 billion (a decrease of 1.5%) in FY2020 1Q to an increase of 25.8 billion yen (an increase of 2.6%) in FY2020 2Q.

- In order to enhance shareholder returns, our board of directors resolved to buy back shares in an amount up to 250.0 billion yen.

-

Please discuss the impact of COVID-19 on FY2020 2Q and the expected outlook for the future.

In FY2020 2Q, as a result of decreases in overseas SI revenues and in revenues from device sales and overseas roaming charges at NTT DOCOMO, among other factors, there was a negative impact of approximately 130.0 billion yen on operating revenues and approximately 20.0 billion yen on operating income. For the fiscal year, our initial forecasts of a decrease in operating revenues of 350.0 billion yen and a decrease in operating income of 70.0 billion yen remain unchanged, based on the anticipated significant negative impact of COVID-19 on overseas SI projects in the second half of the fiscal year and the occurrence of second waves of COVID-19, especially in Europe and the United States. We will work to mitigate the negative impact by rapidly seizing upon changes in the market environment and changing them into business chances, such as by increasing sales under our new service brand, "Remote World," which provides customers with appropriate services for both during and after the COVID-19 pandemic.

-

In 2Q, overseas operating income margin was 2.9%. Please discuss how NTT plan to work towards achieving the medium-term financial target of 7%.

We will continue the structural reforms focused on NTT Ltd. and NTT Data, accelerate the pace of profit improvement, and continue to work towards achieving our medium-term financial target. NTT Ltd. is already realizing the effects of the structural reforms implemented in the last fiscal year, is already advancing its shift to high value-added services and will continue to accelerate this shift in the future.

In addition to the structural reforms in Europe that NTT Data has been implementing since the last fiscal year, it will conduct structural reforms in North America as well and continue to strengthen its digital project support capabilities. Looking ahead to times after COVID-19, we will work to increase our profits by acquiring digital projects, which are increasing worldwide.

-

As a result of the transaction to make NTT DOCOMO a wholly owned subsidiary, indebtedness will significantly increase. Will you continue dividend increases and share buybacks next year and thereafter?

In order to enhance shareholder returns, our board of directors has just resolved to buy back shares in an amount up to 250.0 billion yen. With respect to shareholder returns, our basic policy of increasing dividends on a continuous basis and buying back shares flexibly will remain unchanged.

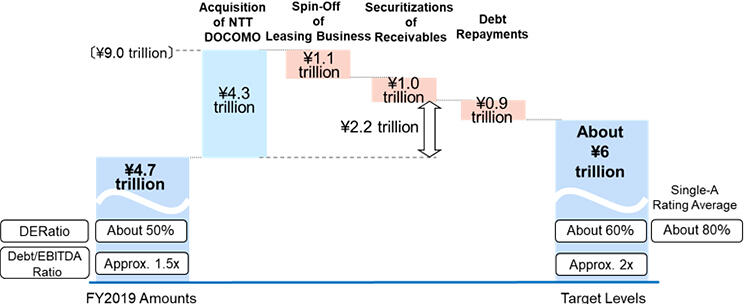

Although our level of indebtedness will temporarily increase as a result of the transaction to make NTT DOCOMO a wholly owned subsidiary, we will reduce our indebtedness through the spin-off of our leasing business and through securitizations of receivables. As before, we will use free cashflows in order to continue to enhance shareholder returns and make investments for further growth, and also plan to repay debt (0.9 trillion) in the next several years down to our targeted debt level of 6.0 trillion yen (a level of approximately 2x EBITDA).

Medium-Term Debt Levels

IR Events · Presentations

- Announcement of New Price Plans of NTT docomo

- FY2018.4Q Financial Results-Key Points

- FY2019.1Q Financial Results-Key Points

- FY2019.2Q Financial Results-Key Points

- FY2019.3Q Financial Results-Key Points

- FY2019.4Q Financial Results-Key Points

- FY2020.1Q Financial Results-Key Points

- Frequently Asked Questions

- FY2020.2Q Financial Results-Key Points

- FY2020.3Q Financial Results-Key Points

- FY2020.4Q Financial Results-Key Points

- FY2021.1Q Financial Results-Key Points

- FY2021.2Q Financial Results-Key Points

- FY2021.3Q Financial Results-Key Points

- 2021.4Q Financial Results : Key Points

- 2022.1Q Financial Results : Key Points

- 2022.2Q Financial Results : Key Points

- FY2022.3Q Financial Results : Key Points

- FY2022 Financial Results: Key Points

- 2023.1Q Financial Results : Key Points

- 2023.2Q Financial Results : Key Points

- 2023.3Q Financial Results : Key Points

- 2023.4Q Financial Results : Key Points

IR Library

Investor Relations

Stock Price (Real Time)

- TSE Prime : 9432

Last -

Change -

NTT STORY

WEB media that thinks about the future with NTT