Microsoft ends support for Internet Explorer on June 16, 2022.

We recommend using one of the browsers listed below.

- Microsoft Edge(Latest version)

- Mozilla Firefox(Latest version)

- Google Chrome(Latest version)

- Apple Safari(Latest version)

Please contact your browser provider for download and installation instructions.

Frequently Asked Questions

Last updated : February 5, 2021

-

Please discuss the purpose and anticipated effects of the transaction to make NTT DOCOMO a wholly owned subsidiary.

The purpose is to enhance and improve the competitiveness of NTT DOCOMO and the growth of the group as a whole. By utilizing the capabilities of NTT Communications, NTT Comware and other companies, we intend to strengthen corporate sales capabilities, service creation capabilities, cost competitiveness and R&D capabilities. In addition, we hope to promote 6G-focused communications infrastructure through integrated mobile and fixed-line services and to cause NTT DOCOMO to evolve into a comprehensive ICT company that also provides upper-layer services.

-

What specific initiatives are being considered? (updated November 24)

Creating new services and solutions that integrate mobile and fixed-line services; collaborating with our partners to strengthen our Smart Life business and create new businesses; optimizing our resources and assets, including our networks, buildings and IT infrastructure to strengthen our cost competitiveness; and advancing our R&D on 6G-generation core networks, the IOWN concept and O-RAN+vRAN.

-

Please discuss your considerations with respect to the initiatives to improve NTT DOCOMO's competitiveness and growth as a result of making it a wholly owned subsidiary.

As one method of improving NTT DOCOMO's competitiveness and growth, we are considering the transfer of NTT Communications and NTT Comware to NTT DOCOMO. As the first step, around the summer of 2021, we plan to make NTT Communications and NTT Comware subsidiaries of NTT DOCOMO, and will also strengthen the collaboration between the research and development capabilities of NTT and NTT DOCOMO. As the second step, around the spring or summer of 2022, we plan to implement a reorganization of the functions of NTT DOCOMO and NTT Communications and work towards a transformation into a new NTT DOCOMO group.

-

Please discuss your views with respect to returns on investment.

Through the transaction to make NTT DOCOMO a wholly owned subsidiary, our ownership ratio of NTT DOCOMO will increase from 66.21%* to 100%, and accordingly, NTT's consolidated net income will increase by approximately ¥200.0 billion (calculated on the basis of results and the ownership ratio for the fiscal year ended March 31, 2020). Furthermore, cash flows are expected to improve as NTT DOCOMO's dividends to minority shareholders and approximately ¥130.0 billion per year of cash outflows out of the group (calculated on the basis of results and the ownership ratio for the fiscal year ended March 31, 2020) will no longer be paid.

In addition, an increase in profit of approximately ¥200.0 billion for the year would yield a return on investment of approximately 4.7%, but we intend that the transaction will result in improved returns through the effect of utilizing the capabilities of other NTT Group companies and by accelerating cost reductions.

*"Ownership ratio" means a ratio of a number of shares to the number of NTT DOCOMO's stock (3,228,629,256 shares) calculated by deducting the number of the treasury shares owned by NTT DOCOMO as of June 30, 2020 (150 shares) from the total number of issued shares of NTT DOCOMO as of June 30, 2020.

-

Due to financing associated with making NTT DOCOMO a wholly owned subsidiary, the company's level of indebtedness will increase. What are the company's plans for this going forward?

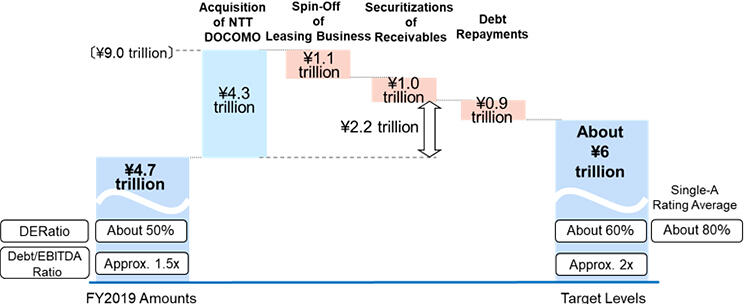

Although our level of indebtedness will temporarily increase as a result of the tender offer, based on the stable profitability and cash flow generation of the group as a whole, we will maintain a policy of preserving financial stability by reducing our financial leverage. Specifically, while the transaction will require approximately ¥4.3 trillion of capital, we plan to reduce our indebtedness through the spin-off of our leasing business (for approximately ¥1.1 trillion) and securitizations of receivables (for approximately ¥1.0 trillion). As before, we will use free cashflows in order to continue to enhance shareholder returns and make investments for further growth, and also plan to repay debt (¥0.9 trillion) in the next several years down to our targeted debt level of ¥6.0 trillion (a level of approximately 2x EBITDA).

Medium-Term Debt Levels

-

Please discuss your views with respect to rating levels. (updated November 24)

With respect to ratings, given the stable profitability and cash flow generation ability of the group as a whole, we plan to maintain our financial stability by reducing our financial leverage, and stably maintain a single-A rating.

Upon completion of the tender offer (as of November 17, 2020), we had ratings of AAA from JCR, A from S&P and A1 from Moody's, maintaining a single-A rating.

-

Is there any connection between discussions to reduce mobile phone charges and this transaction to make NTT DOCOMO a wholly owned subsidiary?

The transaction to make NTT DOCOMO a wholly owned subsidiary started to be considered in mid-April 2020 as a way to optimize the allocation of management resources of the group as a whole and to accelerate the development of a rapid decision-making framework, and there is no direct connection between current discussions to reduce mobile phone charges and the tender offer.

The purpose of these measures is to aim for improved competitiveness and growth of NTT DOCOMO, which will lead to a strengthened financial base of NTT DOCOMO and, as a result, may also be seen as having a positive effect on the realization of price reductions. However, in order to have customers continue to choose NTT DOCOMO, it is important to work to provide further improved services and lower prices going forward, and this fundamental idea remains unchanged both before and after the transaction to make NTT DOCOMO a wholly owned subsidiary.

-

Will this transaction generate "goodwill"?

This transaction will not generate "goodwill." Given that this is an acquisition of minority interests in a company (NTT DOCOMO) that was already a subsidiary, the return of investments from minority shareholders will be accounted for as a reversal of "non-controlling interests" (approximately ¥1.8 trillion) with respect to the capital portion and a reversal of "additional paid-in capital/retained earnings" with respect to the premium.

-

Please discuss the effect of the transaction to make NTT DOCOMO a wholly owned subsidiary on each financial target. Will there be a revision of the financial targets in the Medium-Term Management Strategy? (updated November 24)

Taking into consideration only the effect of an increase in profits proportionate to the acquired minority interest (approximately ¥200.0 billion, calculated on the basis of results and ownership ratios for the fiscal year ended March 31, 2020), we would anticipate:

- EPS: approx. +¥50

(increase in profit; calculated on the basis of results, ownership ratios and share amounts for the fiscal year ended March 31, 2020) * FY2019 Results: ¥231

- ROIC: No effect

(no change in operating income; increase in debt offset by decrease in capital) * FY2019 Results: 6.6%

- ROE: approx. +4%

(increase in profit; decrease in capital) * FY2019 Results: 9.3%

- EPS: approx. +¥50

-

Will there be any change with respect to your approach to shareholder returns?

In order to improve shareholder returns, we expect to increase our aggregate annual dividends for the 2020 fiscal year by ¥10, to a total of ¥105.

In addition, our board of directors recently resolved (November 6, 2020) to conduct share buybacks of ¥250.0 billion. With respect to shareholder returns, our fundamental policy of implementing steady dividend increases and flexibly carrying out share buybacks will remain unchanged.

IR Events · Presentations

- Announcement of New Price Plans of NTT docomo

- FY2018.4Q Financial Results-Key Points

- FY2019.1Q Financial Results-Key Points

- FY2019.2Q Financial Results-Key Points

- FY2019.3Q Financial Results-Key Points

- FY2019.4Q Financial Results-Key Points

- FY2020.1Q Financial Results-Key Points

- Frequently Asked Questions

- FY2020.2Q Financial Results-Key Points

- FY2020.3Q Financial Results-Key Points

- FY2020.4Q Financial Results-Key Points

- FY2021.1Q Financial Results-Key Points

- FY2021.2Q Financial Results-Key Points

- FY2021.3Q Financial Results-Key Points

- 2021.4Q Financial Results : Key Points

- 2022.1Q Financial Results : Key Points

- 2022.2Q Financial Results : Key Points

- FY2022.3Q Financial Results : Key Points

- FY2022 Financial Results: Key Points

- 2023.1Q Financial Results : Key Points

- 2023.2Q Financial Results : Key Points

- 2023.3Q Financial Results : Key Points

- 2023.4Q Financial Results : Key Points

IR Library

Investor Relations

Stock Price (Real Time)

- TSE Prime : 9432

Last -

Change -

NTT STORY

WEB media that thinks about the future with NTT